Streamline your

budgeting.

Get the flexibility and control you need to manage

your business finances by adding sub-accounts that

work just like your main account.

Set your business up for growth

with sub-accounts.

Simplify and manage your budget more effectively for taxes, payroll, and other expenses.

Sub-accounts with their own account numbers

Budget better with sub-accounts that come with their own dedicated account numbers for easy billing.

High APY on main account and sub-accounts

Eligible customers can earn up to 3.0% APY on main account and sub-account balances with one of our business checking plans.BVSUP-00147

Automatic transfers with sub-accounts

Manage cash flow with automatic transfers among your main account and its sub-accounts based on rules you set.

Debit cards for each sub-account

Enjoy more control, flexibility, and peace of mind by issuing debit cards with custom spend limits for each of your sub-accounts.

Multiple accounts, same great features.

Bluevine Business Checking is already a great way to manage your finances. Now imagine what you can do

with up to 20 sub-accounts at your disposal.

| Main Account | Sub-account | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Money movement |

| |||||||||||||||||||||||

| Features |

| |||||||||||||||||||||||

Budget better and spend smarter

with an upgraded plan.

You can do more with extra sub-accounts—all while earning up to

3.0% APY on your main account and sub-accounts balances.

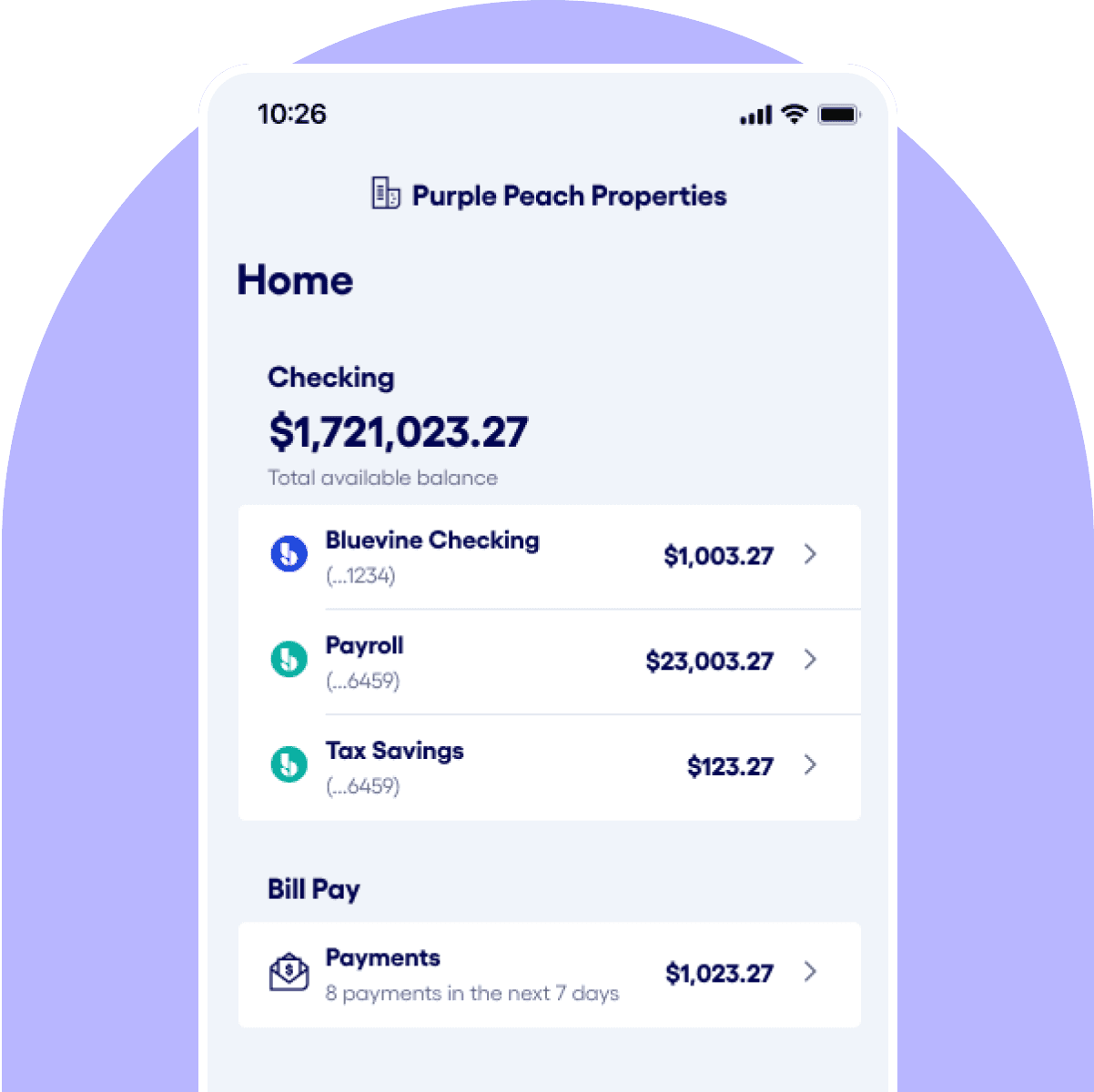

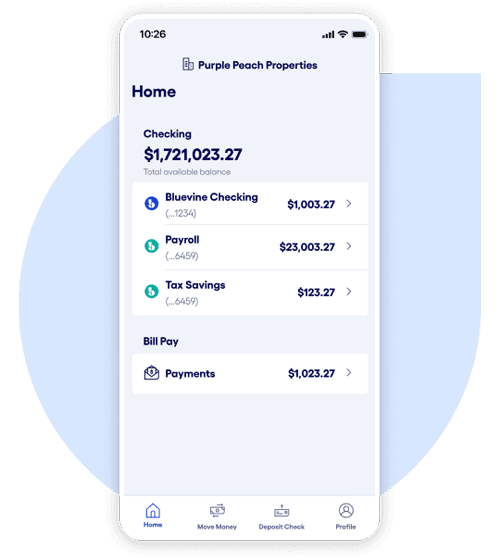

Manage multiple

accounts from a

single dashboard.

Organize budgets, cash flow, and expenses even more effectively with dedicated accounts for each—and control it all from a single dashboard at home or on the go.BVSUP-00055

Frequently asked questions

A sub-account is an account with its own dedicated account number that you can use in addition to your main Bluevine Business Checking account. All Bluevine Checking accounts have the same routing number, but each sub-account will have a unique account number.

Currently, each Bluevine Business Checking account can have up to 5 sub-accounts with the Standard plan. You can have up to 10 sub-accounts with our Plus plan, or up to 20 sub-accounts with our Premier plan.

Only your Business Checking account owner can open a sub-account. Once your sub-account is opened, all additional users will have access and can complete transactions, move money, and make payments across all open accounts.

Yes, each sub-account will come with a dedicated account number. This makes it easier to track how your money moves across your accounts and control which account vendors, suppliers, and contractors can bill. You can also order separate checkbooks if you’d like to make payments from one or more of your sub-accounts.

Yes, you can issue physical and virtual debit cards for each of your sub-accounts, up to 50 total cards for your business. You can also set custom spend limits for each card.

More about Bluevine

Business Checking.

Save on fees

Enjoy no monthlyBVSUP-00122 or overdraft fees, no minimum balance, free standard ACH, and unlimited transactions.

Learn more about Save on feesSimplify your bill payments

You and your team can make or schedule domestic and international payments right from your checking account—via check, ACH, or wire.BVSUP-00137

Learn more about Simplify your bill paymentsGet up to 4% cash back

Earn cashback rewards at 50,000+ merchants with your Bluevine Business Debit Mastercard®.BVSUP-00083

Learn more about Get up to 4% cash backReady for more

effective budgeting?

Submit your application in just a few minutes.BVSUP-00006