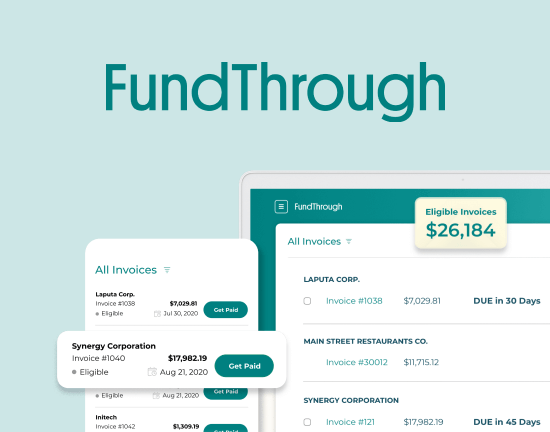

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

There may come a time when your small business needs a cash infusion. Perhaps you need to lease more space or hire additional employees. Or, maybe you need a lifeline to keep your company afloat.

Regardless of what you plan to use the money for, a business line of credit is often the go-to funding solution. Better yet, if you apply for a flexible line of credit through an online lender, you’ll often be approved in less than hour and have the cash in hand within a day or two.

Yet, what if you already have a business line of credit. Should you apply for invoice financing as well? The answer: it depends. To determine whether invoice financing, which is also referred to as invoice factoring, is right for your business, it’s first important to understand the differences between these two types of funding, often used for different purposes. From there, you can decide whether to expand into invoice factoring. Read on to learn more.

Business Line of Credit vs Invoice Financing

What, exactly, is the difference between a business line of credit and invoice factoring? We’ve broken it down for you here:

What is a business line of credit?

A business line of credit is a type of financing that gives you access to cash for your business – up to a certain amount. It’s sort of like a credit card. You tap into your credit line when you need the money. To pay it back, you generally make monthly payments, plus interest.

Some of the biggest benefits of this type of funding include utmost flexibility and fast access to cash. In fact, a line of credit is often the quickest and most convenient way to get the money you need for your small business.

If you already have a business line of credit, you likely needed the funding to pay for a major purchase, invest in your company’s growth or pay your bills during a tough time.

What is invoice financing?

Invoice financing is a great financing alternative if you operate a B2B business. This type of funding allows you to pay your invoices immediately through cash advances. This means you’ll no longer have to wait 30, 60 or even 90 days to get paid by your vendors. With invoice financing, the cash keeps on flowing into your business.

Oftentimes, businesses use this cash flow cushion to pay operational expenses, buy supplies, meet payroll and more. Another perk: you no longer have to turn clients away because you don’t have the available funds to fulfill incoming orders.

Is Invoice Financing Right for Your Business?

If you’re a B2B company and you bill your customers on net terms after the work has been completed, invoice factoring may be the best solution to turn your unpaid invoices into working capital. Unlike a line of credit, which is typically needed immediately to fuel or save your business, factoring is a form of financing you can use to align with your operational needs.

For instance, if you have certain clients that take months to pay their invoices and this frequently ties up your working capital, you no longer have to wait for funds. You can use factoring to get paid right away, freeing up that money to help pay for your day to day expenses needed to get that next invoice out the door.

Los Angeles-based Ella’s Foundation, a non-profit providing housing and support for men in transition, is a prime example. Ella’s Foundation got a $25,000 line of credit through Bluevine in order to immediately meet payroll and cover other essential expenses. As soon as it got back on its feet, Ella’s Foundation moved into invoice factoring to receive immediate payment on vendor invoices. The foundation hopes to pay down its line of credit and migrate primarily to invoice factoring. Why? It’s the best way to “keep the cash flowing,” said Executive Director Ronnie Cansler, in a recent article.

The bottom line

As you can see, a business line of credit and invoice factoring are often used for different purposes. If you already have a line of credit and think your business could also benefit from invoice factoring, take a step back and assess your needs before applying for additional funding. Remember: invoice factoring is still a loan, and you’ll have to pay fees for advances on your outstanding invoices.