How does a business line of credit work?

As one of the staples among business loan options, business lines of credit are very powerful tools for all different types of small business owners. As a small business owner, you can use this type of small business loan for a lot of different purposes, both to invest in your company and help solve cash flow problems that arise.

To find the best business line of credit, you work with a lender to help secure a loan. A strong lending partner is important for a business line of credit, so you can get one with terms that work well for you, and that’s the best fit for your needs now and down the line. That’s the beauty of a business line of credit—it’s a loan for now and later.

Advantages/disadvantages

Business lines of credit have many advantages. First, unlike a traditional business term loan, you are approved for a certain credit limit or line which you can draw funds from during cash flow crunches, and you only pay interest on what you’ve taken out. Additionally, business lines of credit are “revolving,” which means they replenish with funds when you’ve paid them off. That means this capital can be helpful for now and later. You also can secure fast approval with the right documentation.

Disadvantages include that interest rates can creep up if your credit is not very strong. Some business lines of credit also require that you provide collateral, which is a drawback for some small business owners.

An overview of business lines of credit

- Highly flexible uses of funds

- Only pay interest on what you use

- Funds replenish as you pay back

- Great for building business credit

- Bad credit sometimes accepted

- Quick approval

How to qualify for a business line of credit

Business lines of credit are options for many different types of business owners with many different business profiles. Although qualifications due vary from lender to lender, you should be able to get a sense of whether your business could qualify for a business line of credit:

Minimum qualifications

- At least $175,000 annual revenue

- 625–650 minimum personal credit score

- More than a year of time in business

If you apply through a bank for a small business line of credit, it’s likely that you will face more stringent requirements. These vary bank to bank, so you’ll have to check in with your local branch to see if your credit and revenue is strong enough to qualify you. If you apply through an alternative lender, you may see even easier requirements.

What credit score is required for a line of credit?

While we’ve listed 625–650 as the typical minimum range for personal credit score, this requirement can vary by lender. The higher your personal credit score, the more likely you are to get approved for a business line of credit, as long as you also meet the lender’s other minimum requirements for revenue and years in business.

What businesses are eligible for a line of credit?

Generally, lenders will have a list of industries and/or states in which they cannot offer lines of credit. Ineligible industries may include car dealerships, donation-based non-profits, financial institutions and lenders, firearms and paraphernalia, gambling, legal and illegal substances (incl. medicinal marijuana / CBD products), political campaigns, pornography and paraphernalia.

How to apply for a business line of credit

Business lines of credit work in a distinct way. First, unlike a business term loan, you don’t get a lump sum of cash deposited into your business bank account and pay it back incrementally. Instead, you get a credit line that you borrow against and pay back your money through weekly or monthly payments, as you use it. The credit line is “revolving,” or replenishes when you repay the full amount.

If this sounds a bit like a business credit card, in a way, it is. You work with a lender to gain approval for a certain amount of money—the top of your credit line—and then you can “draw” against the business line of credit as you need it.

Another extremely interesting fact about business lines of credit is that many business owners actually have a business line of credit and another type of business loan at once. Usually, taking out a second loan while you still owe on the first can cause big problems, such as automatically defaulting on your current loan. (This is called loan “stacking.”) But, often, business lines of credit don’t count against loan stacking when paired with another loan, such as a business term loan.

Different types of business lines of credit

There are two main types of these loans that you should know about as you begin your search to find the best business line of credit.

Secured vs. unsecured business line of credit

- Secured business line of credit: A secured business line of credit, which most are, requires some form of collateral to “secure” the loan. In case of a default, the lender has the right to seize your collateral and liquidate it to cancel your debt. Collateral can be things such as inventory, your business bank account, and more.

- Unsecured business line of credit: An unsecured line of credit will enable you to lock down a loan without promising any collateral. The trade-off here is that this is more risky for lenders, so they’ll often charge you higher interest rates as a result.

Business line of credit vs. business credit card

If you’re considering a business line of credit as a short-term, working-capital loan, you’ll want to know the significant differences between a business line of credit versus a business credit card:

Business line of credit

- Apply through a business lender for credit line approval

- Pay with money in your business bank account rather than paying on credit

- May take a small amount of time to receive funds from your credit-line draw

- Some business lines of credit include a debit card to instantly access your business line of credit

- Generally higher credit limits, often up to $5 million

- Generally lower APR

- Pay interest against what you draw

- Varying repayment structures, depending on your lender

Business credit card

- Apply through a bank or credit card company

- Pay on credit, rather than receiving money in your business bank account from a business line of credit draw

- Credit limits are generally lower

- APR is generally higher

- Monthly payments required

- No interest payments unless you carry a balance

It’s also worth noting that just like business lines of credit, credit cards can either be secured or unsecured. Secured credit cards require a deposit against the credit line of the card in case the cardholder can’t pay the bill. These are generally for business owners with low personal credit who want to rebuild their credit score by paying off a credit card bill every month. And, like an unsecured business line of credit, it’s difficult to get approval for an unsecured credit card without a reliable credit history.

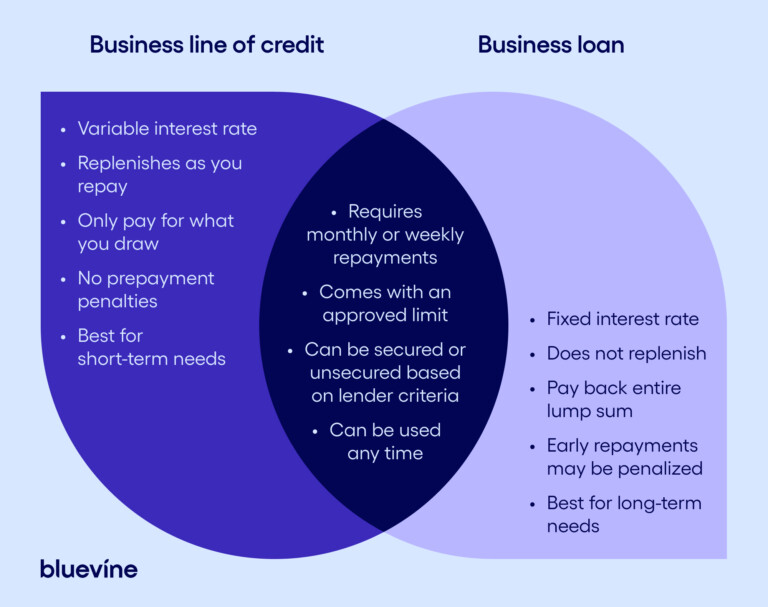

What’s the difference between a credit line and a business loan?

Business lines of credit are not the same as business loans. A line of credit tends to be more flexible because you can request funds from your line as you need them. With a business loan, you get a lump sum that you’re required to start repaying, regardless of how much of it you actually use.

Businesses typically use lines of credit to cover big expenses like equipment upgrades, renovations, seasonal hiring, and more. The ability to draw as you need funds makes business lines of credit a good short- or long-term financing option. Business loans, on the other hand, usually make sense for long-term funding needs because of how long they can take to repay.

How do you apply for a business line of credit?

To apply for a business line of credit, you have to work with a lender. This can be through an online or traditional lender. If you go through a bank, you will likely have to supply more documentation to verify your eligibility:

What are the requirements for a business line of credit?

Different lenders will have different business line of credit requirements they need to see to approve you for a credit line. In general, business lines of credit requires the following documentation for lenders to review:

- Your credit score

- Two to three months of bank statements

- Two years of personal tax returns

- Personal identification

Some lenders may ask for your business licenses and legal documentation, such as incorporation documents and permits to operate, and financial documentation such as profit and loss.

For some extra insight, here’s our guide for how to get a business line of credit.

How much can I get a line of credit for?

While your credit score and revenue information must meet minimum requirements based on the lender, these details will also help determine how much you’ll be approved for with your business line of credit. If your credit score is much higher than the lender’s minimum requirement and you can prove increasing revenue for your business, you may receive a higher line of credit to draw from.

How small businesses can use a line of credit

As business working capital loans, business lines of credit are actually some of the most versatile business financing products available. Here are a few common scenarios in which you can use them:

Financing inventory: Laying out up-front cash for inventory can be extremely expensive. One alternative is inventory-specific financing in which your inventory becomes your collateral in case of default. But business lines of credit can serve a similar function by enabling you to draw against the credit line to finance a purchase order.

Financing equipment: Similarly, business lines of credit can help you purchase equipment, such as computers, without you needing to pursue an equipment-specific loan.

Emergency capital: Accidents happen, such as bathrooms flooding or windows breaking. Business lines of credit can enable you to quickly access capital to pay for short-term expenses that you may not have the cash margin to pay for out of pocket.

Investments: Opportunities often arise for investments in your business. Though you wouldn’t likely use a business line of credit to open a new location or purchase real estate, you could use one to buy out a competitor’s inventory or gear, for instance, or hire a new employee. If you do need funds for large purchases it’s best to look for an SBA or long-term business loan.

Payroll and other general cash flow issues: Business lines of credit are fantastic loans to supplement cash flow, which can be difficult for some businesses to manage well (unpaid invoices, trade credit with long terms, etc.). In cash flow crunch times, they can enable you to make sure you can make payroll, pay utility bills, etc.

See how you could use a Bluevine Line of Credit to grow your business.

How much does a business line of credit cost?

The cost of a business line of credit will vary among the institution from which you borrow, as well as your personal financial history:

- Repayment is generally determined by your credit standing and business financials

- Simple interest can be as low as 5% and as high as 20-25%

- You’ll generally pay above the low end, but below the high end

- The better your credit score, the lower your interest rate

- Unsecured business lines of credit will have higher interest rates

- Lenders may also charge varying fees, depending on whom you borrow from

- A common fee is the “origination” fee, charged when you first secure the loan

Repayment example

The beauty of a business line of credit is that even if you’re approved for a large credit line, you only need to pay interest on what you use, and your line replenishes as you repay. We’ll go through two examples to show you how that could save you money:

Let’s say you have a $50,000 line of credit at a 10% interest rate.

If you took out the full line:

- You’d owe $50,000 of principal

- Principal represents the original amount of the loan

- You’d owe $5,000 in total interest fees

- Your total repayment would be $55,000

- After you pay this off, you’d have access to the full $50,000 line of credit again

If you took out $3,500:

- You’d owe $3,500 of principal

- You’d owe $350 in interest fees

- Your total repayment would be $3,850

- After you pay this off, you’d have access to the full $50,000 line of credit again

Where to find the best business line of credit option

As with many different types of business loans, you have a few options for where to pursue a business line of credit:

Traditional lenders

When people think of traditional business loans, they often think of money originating from traditional banks. You can certainly apply for a business line of credit at a traditional bank—but beware that gaining approval from a traditional lender is easier said than done. That’s because banks are very choosy with whom they loan to, and generally only pick the candidates who have the strongest track records and best creditworthiness.

Additionally, it can take weeks or sometimes months to apply for and get approved for a business line of credit from a traditional bank. This is not to say that you shouldn’t try to get a business line of credit from a traditional financial institution, but rather that you should be open to other avenues just in case you don’t have the figures to gain approval.

Alternative lenders

Online or “alternative lenders” are a fantastic option for business lines of credit. You can get funds same-day — much faster than traditional institutions. Additionally, they will take on candidates with less-than-perfect credit and business history, which opens up options to all types of business owners. This can mean that rates will be slightly higher to compensate for risk. These lenders often offer a more tech-forward approach, which can include reporting dashboards and online integrations into your business bank account or accounting tools.

Bluevine

Among these alternative lenders is Bluevine. We offer access to business lines of credit at competitive rates to other online lenders with low fees, and provide access to working capital for younger businesses (you only need six months in business to apply). Apply for a business line of credit with Bluevine, work with a representative, and find out if you’re approved for funds in as little as one day.

A business line of credit is a well of funds your company can pull from and use if and when you need to. A line of credit is a flexible funding method, which opens up growth opportunities that might otherwise be unavailable. For example, a line of credit can provide financial stability if you encounter unexpected expenses or seasonal fluctuations in revenue.

If you’re looking to boost growth, you can purchase more inventory or operations equipment, or fund a new marketing campaign. If you’re expanding, a line of credit can help you open a new office or location, or it can support a new product launch.

Any business line of credit will require that your business be in good standing with no bankruptcies for the past three years. Most will also require that you have a 625+ FICO score and are in business for at least 24 months and are generating $40,000 in monthly revenue.

When you submit your application, the line of credit provider will ask you for official documents with your and your business’s basic information, and a bank connection or bank statements for the past 3 months.

No—a business loan is a lump sum of money, whereas a line of credit is a long-term pool of money you can draw from upon request. Both business loans and lines of credit have to be paid back with interest. Lines of credit are typically ‘revolving,’ which means your available pool of funds replenishes as you repay what you borrowed. When you repay a business loan, you’ll have to apply for another if you need more funds.

Generally, business loans serve one purpose and lines of credit another. Loans are good for financing specific projects that require an upfront investment. Lines of credit are better suited for long-term support, such as during sales slumps or emergencies.