Being the ‘boss’ has its perks, but it can also be challenging. Success often hinges on execution as much as on your initial plans to manage cash flow, invest in growth, control your expenses, hire new talent, and market your products.

As part of our Business Owner Success Survey™ (BOSS), we surveyed nearly 1,200 small businesses nationwide and delved into the strategies and tactics that drove their success in 2023, as well as the decisions and investments they expect to make in 2024 to reach their goals. One of our findings was that 66% of business owners prioritize advice from fellow business owners above all other sources—so check out a summary of our findings below, or explore the report in-depth for even more comprehensive insights.

Read the full BOSS Report to see how small business owners are approaching 2024.

Overview

The BOSS Report, an analysis of our nationwide survey, is meant to inform business owners like you about what’s working for your peers, so you can better plan, budget, and perform to achieve success for your own company in the year ahead.

Our respondents and methodology

We surveyed 1,197 small business owners to create benchmarks on the state and direction of the U.S. small business sector from the owners’ perspective. Our respondents were all business owners with up to 50 employees and annual revenue between $100,000 and $5 million. Their diversity of age, gender, location, and industry broadly reflect U.S. small businesses.BVSUP-00130

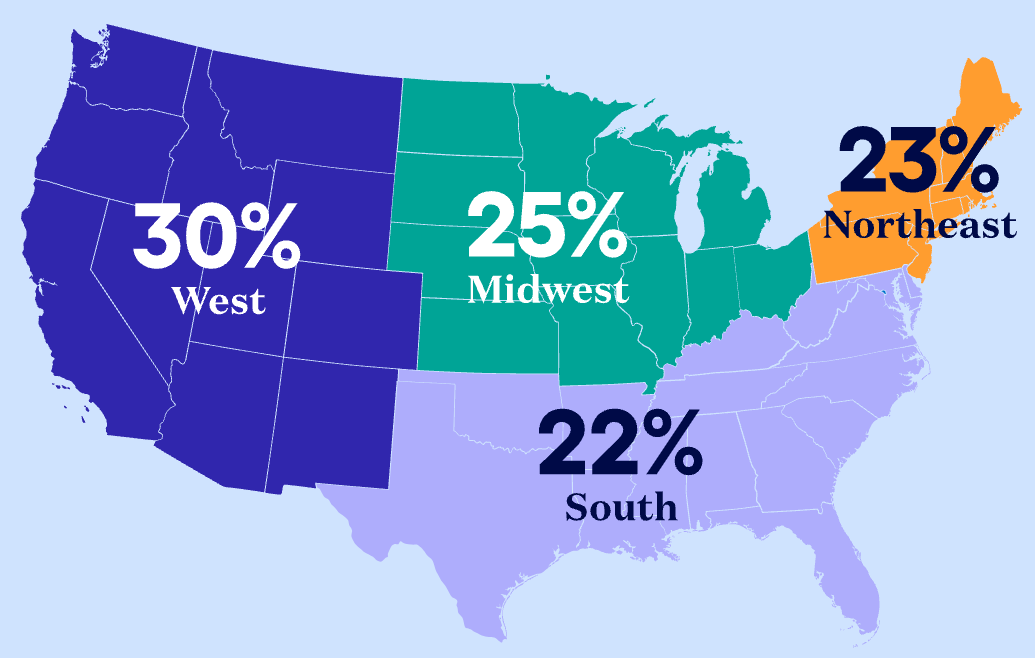

- Respondents were evenly spread across the west (30%), midwest (25%), south (22%), and northeast (23%) United States.

- Respondents were predominantly aged 25-64 (86%), divided into 25-34 (20%), 35-44 (27%), 45-54 (22%), and 55-64 (17%).

- 57% of respondents self-identified as male and 43% as female.

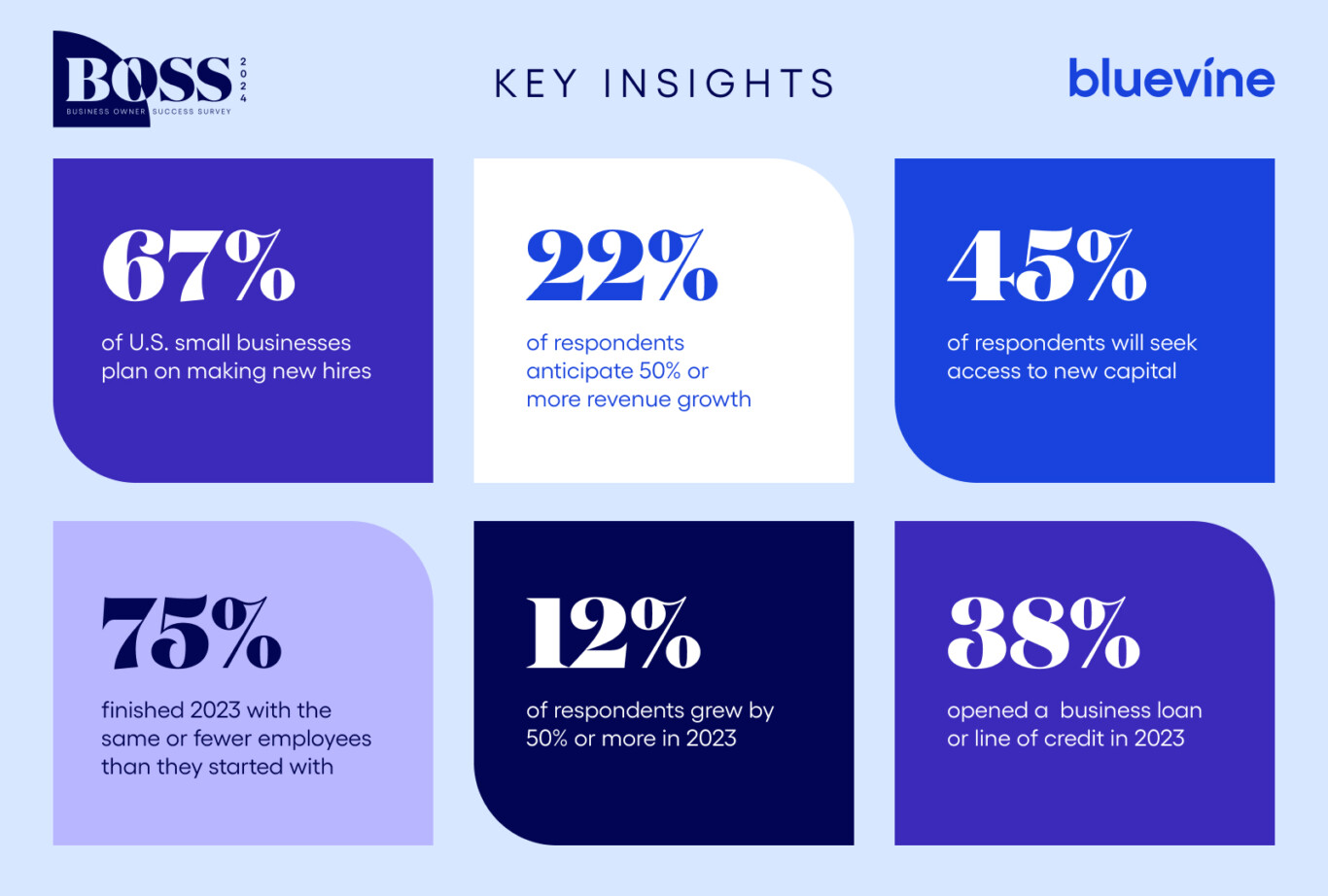

Some key insights

Looking to 2024, U.S. small business owners expect more stable and favorable macroeconomic conditions and are planning accordingly.

We asked respondents, “What was the single best thing you did in 2023 to ensure the success of your company?” Here’s what they said:

- 29% sharpened their business strategy

- 22% invested in marketing and sales

- 17% managed finances with more purpose

Our respondents came from a diverse range of industries, but these were the most represented among U.S. small businesses in 2023:

Results and analysis

Growth

93% of respondents reported profits in 2023. To endure an uncertain 2023, these U.S. small business owners leaned into their efficiencies. In doing so, they’ve set themselves up to achieve even greater ROI from growth and marketing investments in a more stable 2024.

89% of business owners have a growth goal of 10% or more in 2024, and 22% project growth of 50% or more (almost twice as many as the 12% of SMBs that achieved this level of growth in 2023).

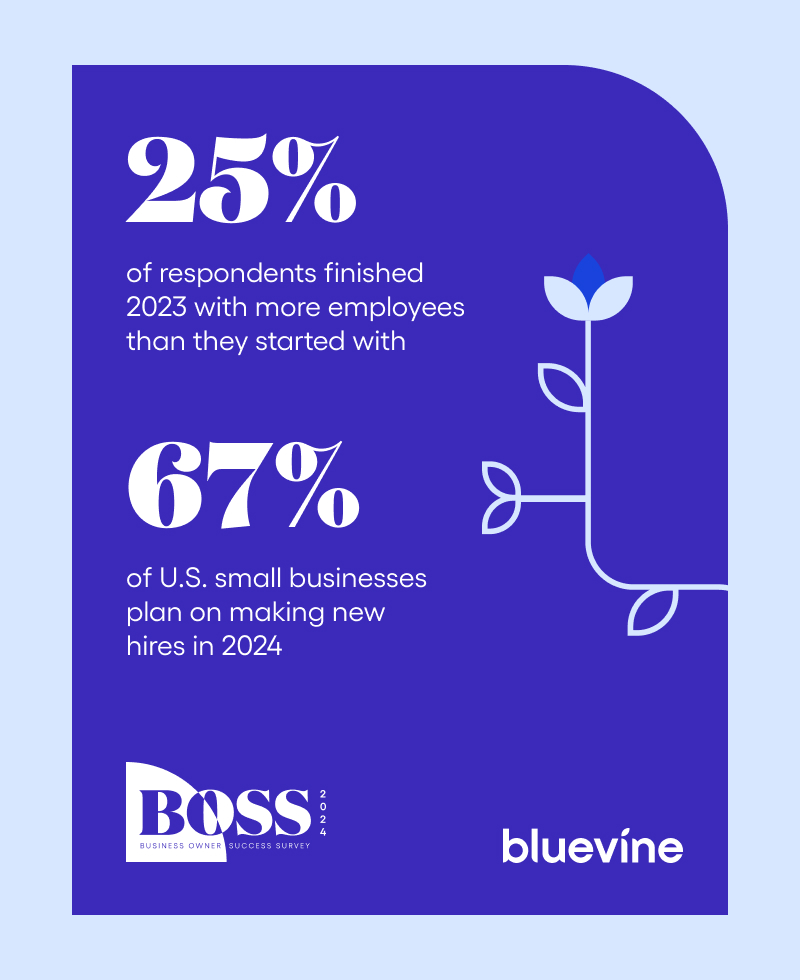

Workforce and hiring

One area in which businesses remained conservative last year was hiring—the size of the U.S. small business workforce remained fairly stagnant in 2023. In 2024, respondents expect to expand their teams.

Marketing

Every single respondent (yes, 100%) managed more of their marketing in-house than they outsourced. Digital marketing will continue to dominate, but U.S. small businesses still hope to root themselves in their communities with local advertising and in-person events.

We asked respondents what their top three marketing priorities were for 2024:

As for the least popular channels, 73% of respondents won’t be spending anything on TV spots in 2024, and 70% won’t be spending on podcasts. Despite the explosion in consumer consumption of streaming, small businesses just aren’t seeing value in advertising spend here.

Financial management

Our survey reaffirmed that business owners prioritize financial management as a major factor in their company’s success. In 2024, they’ll be seeking lenders and business credit cards to support ambitious growth plans and save time. Of those seeking loans in the year ahead, 55% are looking for a new credit card and 55% a new line of credit or term loan lender.

The main attributes respondents are prioritizing in a business checking account include:

- 49% no monthly fees

- 28% unlimited transactions

- 26% no overdraft fees

Operational savings and spending

Just as important as where small businesses spend is where they save—cutting material costs was a top priority for business owners in 2023, and remains so for 2024.

Of the top six areas where U.S. business owners aim to save time in 2024, half are related to banking and finance. Over a third of U.S. small business owners admitted to spending 7.5 workdays per year banking at branches, including travel time. In addition, more than 1-in-5 respondents spend more than 6 workdays per year on branch banking activities.

We also asked a few questions about fine-tuning their operations:

| Respondents listed their top three most used business software in 2023: 55% accounting 48% payroll 35% bill pay | Respondents listed where they hope to save time in 2024: 34% bookkeeping / accounting 33% administrative activities 28% social media management |

See how you could save time by switching business bank accounts.

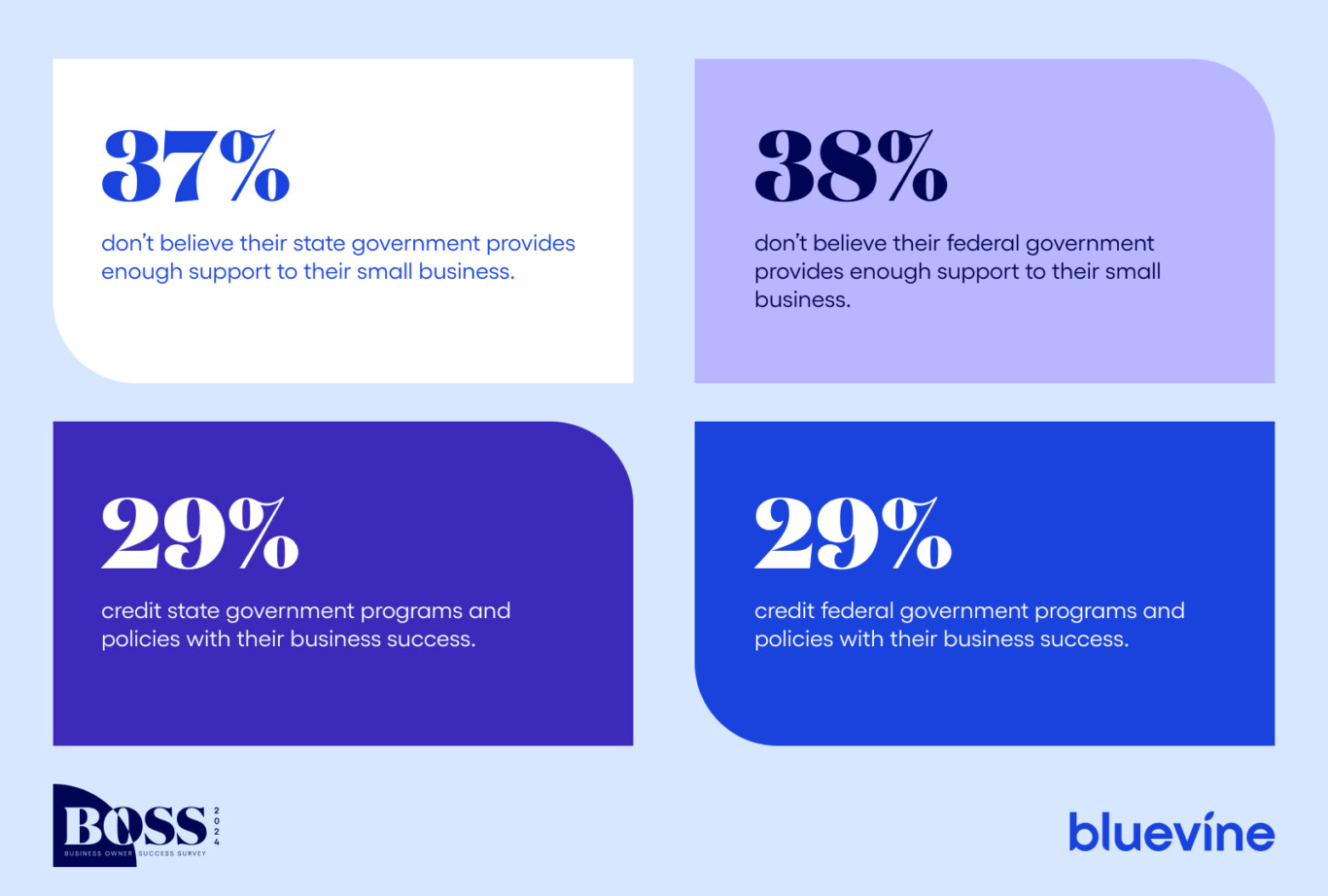

Impact of public policy

U.S. small business owners felt that both their state and federal governments could offer more support to small businesses compared to 2023.

Explore the 2024 BOSS Report

For additional findings, detailed breakdowns of the numbers above numbers, and further analysis, explore the full 2024 BOSS Report by clicking the button below.