There’s no denying that accounting is one of the most crucial—albeit often one of the more dreaded—parts of running a business. However, it can also be particularly time-consuming, particularly for those without a strong handle on how to manage the books. According to a survey by the National Small Business Association (NSBA), nearly half of entrepreneurs say they spend over 80 hours a year on basic accounting, with 20% saying that 120+ hours of their time go to federal taxes alone.

However, despite how big of a burden and time commitment accounting and bookkeeping are for business owners, it can feel like outsourcing those operations is counterintuitive if you’re looking to improve your cash flow. After all, your business will be taking on an additional expense for something that could technically be done in-house.

Here’s the thing: While outsourcing your bookkeeping and accounting activities is an investment, it could also set you up for stronger cash flow and financial health in the long run. Here are a few of the ways that working with an accountant or bookkeeper can boost your business’s cash flow over time.

Frees up your time as a business owner.

As highlighted by the NSBA survey results above, accounting and bookkeeping is hardly a miniscule task when you look at the amount of time that business owners spend on it throughout the year. Between taxes, invoicing, payroll, receipt management, and other day-to-day accounting functions, business owners spend a good chunk of their time tackling accounting tasks. For those without the required knowledge or expertise, there’s also plenty of time that needs to be spent on learning the ins and outs of accounting in order to manage everything properly.

All of that time spent on accounting is essentially time away from other business functions, including revenue-generating activities. By outsourcing your accounting and bookkeeping, you can reclaim that time to invest it back into business activities that are more directly related to increasing your revenue, including implementing new marketing strategies, engaging with customers or clients, and improving your products or services.

Provides stronger insight into business finances.

Trying to keep your business finances organized and stay on top of your money can be exhausting—especially if bookkeeping is outside of your wheelhouse. By working with an external bookkeeper, not only can you afford yourself more peace of mind as a business owner, but you can also ensure that you’re getting more reliable insights into your business performance. By consistently monitoring your business transactions, tracking expenses, and looking at your income month-over-month, experienced bookkeepers can give you a clear financial picture of your business overall as well as provide detailed insights regarding the return on individual investments. For example, by running monthly financial reports, you might be able to identify a spike in revenue as a result of a specific marketing campaign.

Overall, a bookkeeping expert will reliably and efficiently help you feel confident in your understanding of how money is flowing in and out of your business, which in turn allows you to identify opportunities to improve or boost your business processes to drive more revenue.

Gives you essential support at a more affordable cost.

Outsourcing accounting and bookkeeping can also support better cash flow by providing a cost-effective alternative to hiring an in-house accountant. For starters, you would only be required to pay for the specific services you need on a monthly basis, which creates more flexibility when it comes to laying out the scope of work. Rather than keeping someone on staff year-round, you can work with your external accountant and bookkeeper on a schedule that makes sense to your business and pay only for what you need. Additionally, outsourcing eliminates the overhead costs—payroll taxes, benefits, vacation/sick days, retirement plans, etc.—that come with hiring a full-time accountant or bookkeeper.

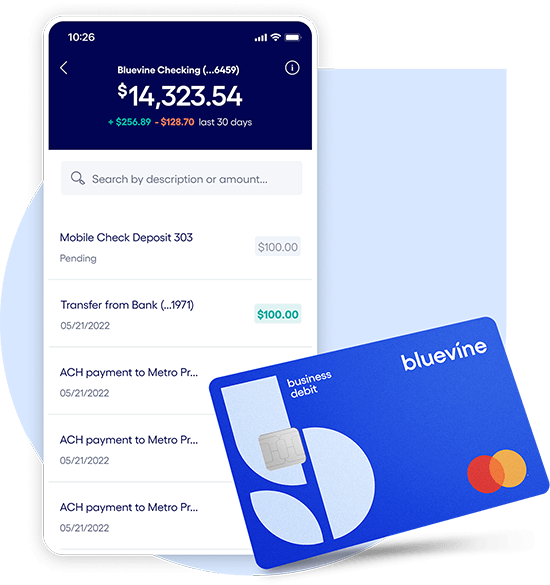

Small business checking, built for your needs

Unlimited transactions, live support, high-interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more