Despite the fact that small businesses are the lifeline to our economy, it appears that a majority of them experience significant challenges with their current small business banking services. According to a survey of over 1,000 business owners conducted by Bluevine and Researchscape, only 9 percent of small business owners say their current bank meets all of their small business needs. Further, 7 in 10 (69%) business owners polled say they would be willing to switch to a bank that provided all the banking features and services that they need.

This and other findings from the survey provide a glimpse into the state of American small businesses’ satisfaction with their banks today. The small business banking market research indicates that there is vast room for improvement across the features and services banks are currently providing their small business customers. These results are pointing to a widespread willingness to switch to a new bank, as seen in the survey. Among the survey’s key findings are:

Small Business Owners are Paying Too Many Banking Fees

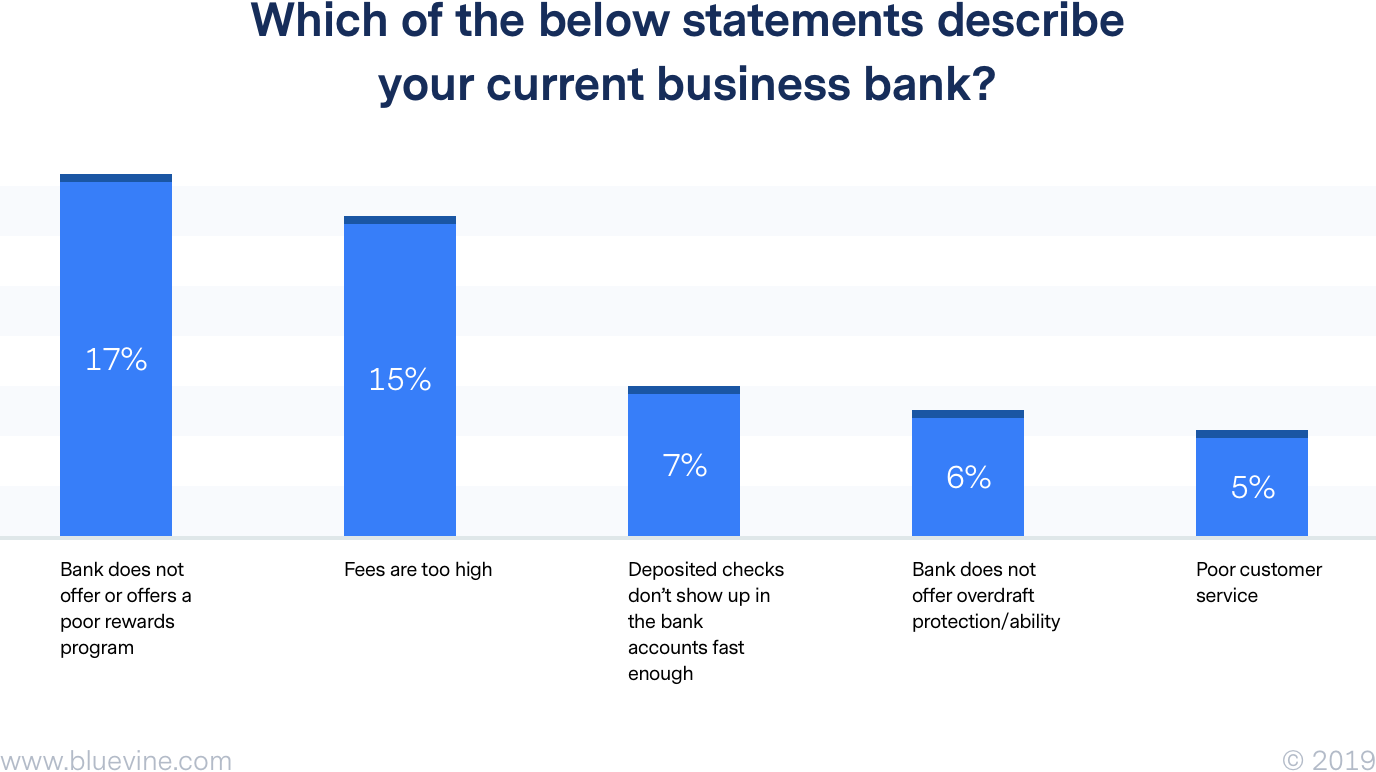

According to our survey, 65% of small business owners pay banking fees and 15% believe that their fees are too high. In fact, the average small business customer pays $451 in fees per year, according to ACI Universal Payments. Common fees that small businesses experience include “service” or “maintenance” fees, in-network ATM fees, bill-pay fees, incoming wire fees, paper fees and transaction-minimum fees.

Unfortunately, even though small businesses are paying expensive and confusing fees, they are not getting the service or features that benefit them most. According to survey results, 7% say deposited checks don’t show up in their bank accounts fast enough, 6% say their bank does not offer overdraft protection/ability, and 5% report poor customer service. These basic banking features – such as accessing funds or receiving customer service – are banking ‘table stakes’ yet small businesses are not receiving them.

Small Businesses Still Can’t Get Access to Capital

Two in five (39%) small business owners from our survey report they have difficulty getting financing (such as lines of credit, loans and credit cards) from their current bank. These findings are in line with additional industry research that shows that only about 26 percent of big banks approve small business loans, and 27 percent of small-business owners are not able to obtain adequate financing.

As lack of capital continues to be a top challenge for many small business owners and bank loan approval rates remain low, applicants are increasingly seeking options outside of their bank. For example, 32% of small businesses sought out financing from online lenders in 2018, up from 24% in 2017, according to the Federal Reserve.

Banks are Providing Poor Rewards to Small Businesses

According to survey results, 17% of small business owners say their bank does not offer or offers a poor rewards program. Compared to their corporate counterparts, small businesses don’t receive the same level of rewards or benefits including leading-edge products and digital solutions, according to the FIS Performance Against Customer Expectations (PACE) Report. In addition, small businesses are not seeing their checking or savings accounts grow. As of September 16, 2019, the FDIC reported the national interest rate average for savings accounts is 0.09% and interest rate checking is even lower at 0.06%.

“Our survey showcased compelling results demonstrating the lack of banking services for small business owners including rewards, financing and even basic customer service,” said Eyal Lifshitz, CEO, Bluevine. “There are vast improvements that can be made to serve small business owners who often cover the roles of both CEO and CFO and are seeking an end-to-end banking experience.”

To learn more about how Bluevine supports small business banking needs visit: https://www.bluevine.com/about/.