It has been more than 10 years since the last U.S. recession, which rocked small businesses across the country. Loans from traditional banks came to a standstill, and nearly 1.8 million small businesses closed their doors between December 2008 and December 2010 (source: Investopedia).

With economic expansions in the U.S. lasting just over three years on average, we are long overdue for a contraction. In fact, there is potential for another recession on the horizon, with predictions of possible impact starting as early as the end of this year. This means small businesses have the potential to be hit the hardest once again if they don’t take the right recession-proofing precautions.

Business Strategies to Prepare for Recession

In partnership with market research firm Researchscape, Bluevine polled more than 1,000 U.S. small business owners to get a pulse check on their concerns about a potential recession and steps they are currently taking – and plan to take – to prepare.

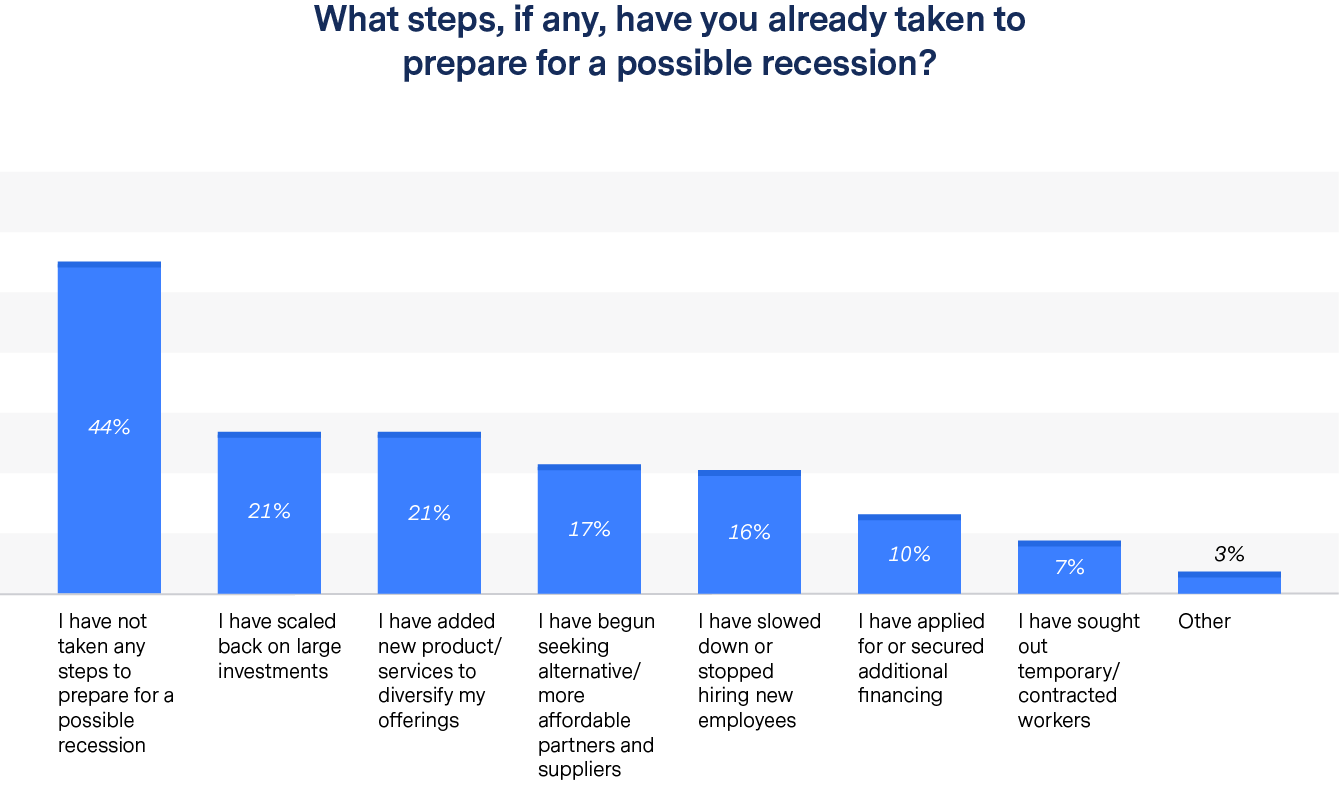

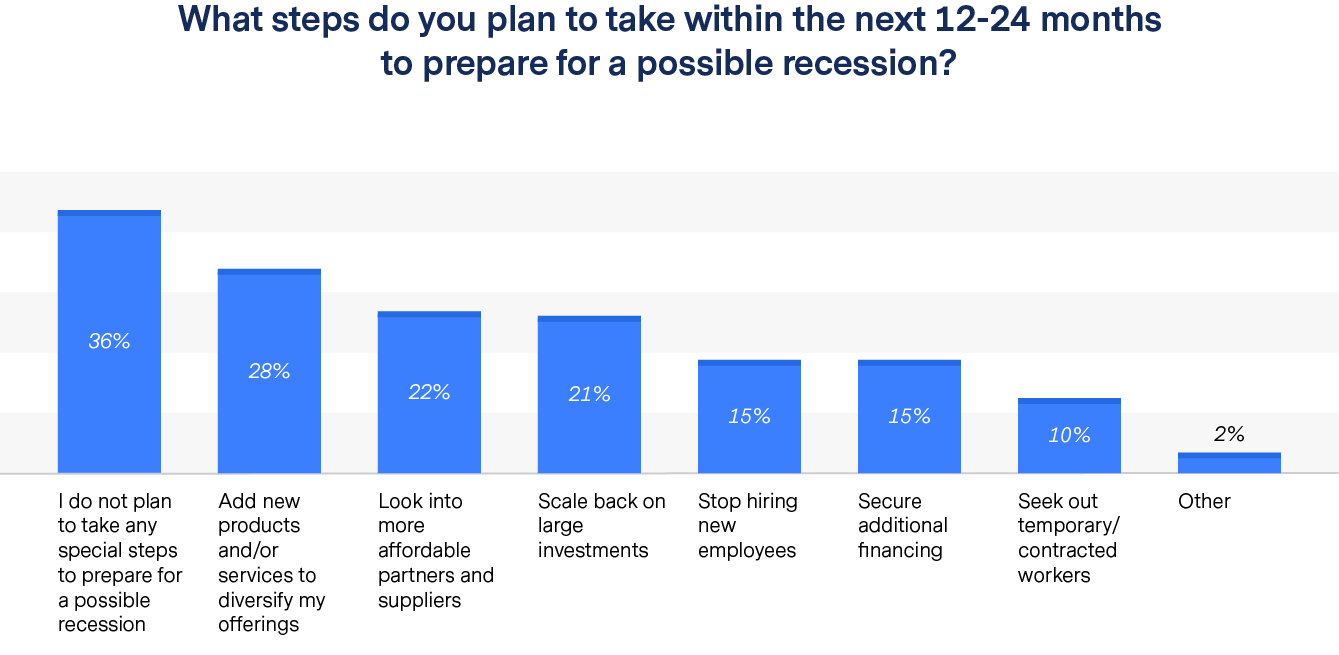

Among the survey’s key findings are that while 80 percent of small business owners worry about a possible recession, 44 percent have not yet taken any steps to prepare and 36 percent do not plan to take any special steps to prepare within the next 12-24 months.

Of the business owners that are taking or plan to take steps to recession-proof their businesses, the survey also found that the following activities are top priority:

Adding new products and/or services to diversify offerings

- 21 percent have already done so

- 28 percent plan to do so within 12-24 months

Scaling back on large investments

- 21 percent have already done so

- 21 percent plan to do so within 12-24 months

Seeking alternative/more affordable partners and suppliers

- 17 percent have already done so

- 22 percent plan to do so within 12-24 months

Slowing down/stopping hiring new employees

- 16 percent have already done so

- 15 percent plan to do so within 12-24 months

Financing a Business During Recession

Perhaps the most surprising, however, is that obtaining financing appears to be a lower concern and priority for small business owners to prepare for a potential economic downturn. In fact, the survey found that:

- Fewer than 1 in 5 (19 percent) small business owners worry about not being able to obtain financing;

- Only 10 percent have applied for or secured additional financing already; and

- Only 15 percent plan to secure additional financing within the next 12-24 months.

While steps like adding new products or finding more affordable suppliers are important to recession-proofing and shoring up the bottom line for many small businesses, securing financing well ahead of an economic downturn is critical to expanding cash flow and weathering the potential storm.

In the event of a downturn, credit and capital will be difficult to secure, just as it was during the Great Recession. The golden rule of financing is the best time to seek financing is when you don’t need it. As a possible recession looms, it is critical that more small business owners begin investigating working capital now while the economy is strong, business needs are minimal, and the business is in solid financial standing to be approved by a lender.

“Intensified by recent Federal rate cuts and increasingly vexing predictions from economic forecasters, speculation continues to swirl around a recession striking within the next few years,” said Eyal Lifshitz, CEO, Bluevine. “Small businesses should be taking time now to prepare their business while the economy is still strong, particularly when it comes to getting the right financing to withstand any economic condition.”

For more tips on how your small business can prepare for a potential economic downturn, view our “Small Business Recession-Proof Checklist,” below.