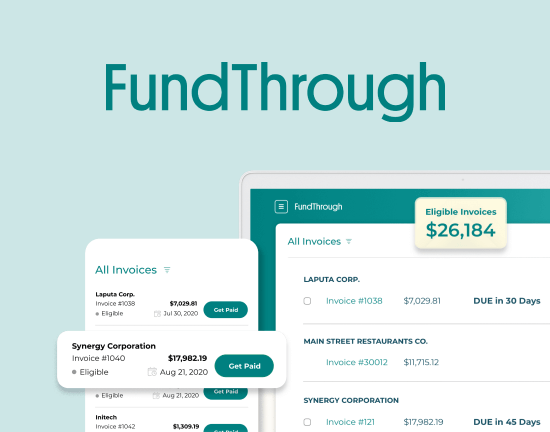

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply nowWhat is invoice financing?

Consistent cash flow can often be one of the most difficult hurdles for small business owners to overcome. Without consistent cash flow and a strong cash margin, it’s hard—if not impossible—to pay for things including operations, general overhead, and payroll. Invoice financing is a way for entrepreneurs to put themselves in a better cash position.

What is invoice financing? It’s a type of small business loan that enables business owners to get a cash advance on unpaid invoices. This is especially crucial for companies that use trade credit for their customers (in other words, “net terms”).

We’ll go through different options for invoice financing (and invoice factoring, which is slightly different), and explain how they affect your business. We’ll also cover requirements for invoice financing, and how to apply and qualify for these small business loans.

An overview of invoice financing

-

- Enables small business owners an advance on unpaid invoices

- Frees up cash tied up in outstanding invoices

-

- Lenders advance up to 85% of your outstanding invoice

-

- No recurring payments

-

- Loan is self-secured, meaning that the invoice itself serves as collateral

-

- Easier to get approved for than other loans

Invoice financing for small businesses

Invoice financing, also called accounts receivable financing, has many advantages for small business owners. First and foremost, it enables you to free up cash on unpaid invoices that are due in the future. This is immensely helpful for small businesses who rely on customers to pay invoices, but don’t necessarily have control over when they get paid—or offer longer-term trade credit. Fees for invoice financing are often very transparent, and you won’t need to be responsible for recurring payments to repay your lender.

One of the biggest disadvantages of invoice financing or factoring is that you won’t get the full invoice amount since you’re paying a small premium to have the money advanced to you. For many businesses, it’s worth it, since outstanding invoices can constrict business operations. Another disadvantage of invoice financing is that if your customer doesn’t pay up, the lender collects the balance of the invoice, since the invoice secures the loan.

Who qualifies for invoice financing?

One of the biggest advantages of invoice financing is that it’s available to a wider range of business owners than many types of small business financing. Unlike, say, a term loan, which considers a business’s holistic financial profile, lenders generally limit an application to a credit check to ensure that business owners have a relatively stable financial history.

This means that businesses that don’t necessarily have strong financial credentials, a great deal of operating history or time in business, or very strong revenue numbers may be good candidates for invoice financing.

Minimum qualifications

As we touched on, invoice financing companies generally don’t require the same comprehensive evaluation of your financial profile in the same way as they would for other types of small business loans. This is a massive advantage for businesses that are growing, and who don’t have quite the well-rounded profile that lenders are looking for.

The most important part of qualifying for invoicing is your business model—this type of financing generally only applies to business-to-business (B2B) models. That’s because payment is due from customers when they make a purchase, unlike enterprise clients, which are often invoiced on net terms, giving them time to pay (we’ll cover this in more depth in a bit).

In general, the only important qualification for invoice financing that you need to be aware of is your credit score.

- Annual revenue not standardized, but generally around $100,000

- Time in business not standardized, but generally around three months minimum

- Credit score minimum around 530

How does invoice financing work?

In invoice financing, a lender will front you generally up to 90% of an unpaid, outstanding invoice on your books. Then, once your customers pay the remaining balance, you collect the remaining 10% of the invoice value, minus lender fees. In this way, you don’t get the full balance of the invoice, but many business owners find that paying a factoring fee is worth it, since access to the cash is so advantageous.

Although you don’t get to choose the amount of business funding you’ll get—it’s equal to the amount of the outstanding invoice—invoice financing can be far less stressful on a business’s bottom line. That’s because, importantly, unlike other small business loans that require recurring payment terms (which can be either monthly or even weekly or daily), you’re not responsible for the balance of your funding until your customer repays the balance on the invoice.

Another component of invoice financing is collateral—or lack thereof. Many types of small business financing require you to secure your loan, whether that’s against a bank account, a physical asset, or with a UCC blanket loan. Similar to equipment financing, invoice financing is self-secured, which means the invoice itself serves as the collateral asset. That means no additional assets are required to secure the loan.

This is a very quick type of small business financing; often, a lender will approve you for invoice financing in fewer than 24 hours. This is a massive advantage to invoice financing, which enables you access to working capital faster than other kinds of small business loans, for which you may have to wait slightly longer for approval. If, for instance, you find yourself in a cash crunch, you can take advantage of invoice financing to help ease cash flow issues.

It’s also important to note that many types of businesses take advantage of invoice financing. That includes small operations as well as massive ones; for instance, think of a company such as an airplane manufacturer, which may only make a few, very high-price sales a year and give clients a substantial amount of time to pay their large invoices. Freeing up that capital is essential for these kinds of companies to continue their operations. Other industries that commonly use invoice financing include:

- Business services

- Consulting

- Hospital and nursing homes

- Manufacturing

- Staffing agencies

- Trucking

- Wholesale

Invoice Financing vs. Invoice Factoring: What’s the difference?

There are two primary types of invoice financing, so let’s explore the specifics.

Invoice financing vs. invoice factoring

With invoice financing, you are the sole entity working with the lender. You’re responsible for paying back the lender once the balance of your invoice is paid. In this sense, only your creditworthiness is taken into consideration for approval.

In contrast, invoice factoring means that you’re actually selling the unpaid invoice to a lender. The balance of the invoice is then collected directly from your customer. Some businesses don’t like a customer to know that they’re using a lender to collect payments, but that’s solely up to you.

With invoice factoring, some companies will advance you 100% of the invoice minus fees; others will advance you more like 85% to 90%. This generally depends on the strength of your customers—in other words, your credit line is dependent on whether your customers have been responsible for invoice payments in the past.

Invoice factoring vs. invoice discounting

Invoice discounting is synonymous with invoice financing—it’s generally the type of financing we’ve been talking about in which a lender fronts you money for your invoice, and you deal with them directly. Since invoice financing can often be used as a blanket term, which includes both discounting and factoring, if you want to be specific, you can say “invoice discounting” to indicate your relationship to the lender.

As we mentioned above, factoring sells the invoice to the invoice factoring company, who will collect payment on your behalf from the customer. In this way, the customer knows that you’ve used invoice financing. With invoice discounting, you’re responsible for the outstanding balance, and the customer never knows you’ve used a financing service.

How to apply for invoice financing

Invoice financing—including both invoice factoring and invoice discounting—is facilitated through a lender. The finance company will evaluate your credentials, approve you, and set the terms and fees.

Documents you need

One of the advantages of invoice financing is these types of loans are not paperwork intensive at all. Generally, you can apply to a lender with just the following documentation:

- Credit score

- Basic details about your business (such as your industry and time in business)

- A couple of months of bank statements

- Information about your outstanding invoices

How do small businesses use invoice financing?

We keep using the words “cash flow”—and that’s for good reason. Taking stress off of your cash flow and getting immediate access to working capital you’re due is the primary reason that businesses take advantage of invoice financing.

This can help take care of expenses including:

- Overhead, such as utilities and rent

- Payroll

- Financing purchase orders

- Your own outstanding invoices

- Credit card bills

…and more.

As the majority of invoices are paid late—60% by some estimates!—the option to access capital when you need it, instead of when your customers deliver it, can be a matter of survival for some businesses that operate with a slim cash margin.

Invoice financing companies offer a range of credit lines—that means you can often finance invoices as small as $5,000 and as big as $5 million.

Invoice factoring rates and fees

As with any type of small business loan, fees from a factoring company will vary from vendor to vendor. In general, the amount you’ll pay for invoice financing is dependent on how long your customer takes to pay the invoice; the fee is generally calculated weekly, but not due until you repay your advance.

Here is how fee structures generally work:

Advance/processing fees: This is a flat fee that lenders often take to facilitate the loan (a comparable example is an origination fee on something like a term loan). This is generally around 3% and comes out of the remaining 10% to 15% that you collect when your balance is repaid.

Weekly factor fee: The amount that your invoice financing will cost is almost always determined on a weekly basis, depending on how long your invoice is outstanding once you take the loan. This may range from 0.5% to about 3% each week.

Repayment period: As we mentioned, you will not owe any weekly payments on the invoice you finance. Rather, your balance is due when your client pays you.

Collateral: You won’t need to offer any additional collateral since the invoice serves as collateral for the loan.

Repayment example

Let’s say you’re financing a $50,000 invoice. If you’re advanced 90% of this invoice amount, you’ll receive $45,000 upfront. The lender holds the $5,000 left over.

Your customer takes three weeks to pay the invoice, and your financing company collects 1% each week (in other words, you’re paying 3% for the time to repayment). Additionally, there’s a processing fee of 3%.

From the $5,000 that’s remaining, the financing company will collect $1,500 for the first 3% fee, and another $1,500 for the second. That means they’re getting paid $3,000, and you’ll get the remaining $2,000. That means you’ve paid $3,000 to get the money three weeks early.

Where to find the best invoice financing option

Traditional factors

There are many traditional factoring companies which tend to serve specific regions and industries. Traditional factors have the ability to offer lower rates than alternative lenders, but have much more restrictive contracts and typically make you factor all of your accounts receivables. With a traditional factor, you’ll also be looking at longer approval times than an online factoring company.

Alternative lenders

Even if you have a relationship with a business bank, the overwhelming majority of traditional banks won’t offer invoice financing and factoring to businesses. They will often refer you out to alternative sources, including online lenders, which generally provide more funding options to a wider range of businesses.

Turn unpaid invoices into working capital with our partner, FundThrough.