The COVID-19 pandemic has forced many small businesses to rapidly pivot and digitally transform their strategies in the wake of store closures and sheltering in place. While some industries and local economies show promising signs of recovery, the future remains uncertain for many small business owners with several pundits believing we may never return to “business as usual.”

As small business owners adapt to a state of business uncertainty, they need a banking solution that can keep up and serve their unique needs while economies continue to be in flux.

This begs the question: what kind of business banking solution do small businesses need now?

We recently surveyed over 800 U.S. small business owners to find out and uncovered some compelling findings about the benefits, features, and capabilities most important to them.BVSUP-00031

Every dollar counts—especially now.

More than ever, small business owners do not want to be nickeled and dimed by their bank and seek solutions that help grow their account—not pinch every penny.

Nearly three in five (58%) small business owners rank not having any overdraft, monthly, or maintenance fees among the most important benefits in a business checking account. One-third (35%) said they want to learn more about a fee-free business checking account.

Similarly, a monthly or annual fee is the most important factor considered when applying for new credit, and fees were also top of mind for most respondents when asked where business banking services could be improved.

Businesses expect transparency and demand trust from their banks.

Many small business owners need more than just a checking account from their business banking provider—they also need a partner they can lean on in times of need.

With more than three-quarters (77%) of small business owners reporting taking on day-to-day accounting, direct support and guidance from their bank is critical. When asked to rank the top business checking account benefits, great customer service ranked second overall.

We also asked survey participants to share their thoughts on the biggest area where business banking services could be improved. Several highlighted customer service, communication (including listening and fast responses), and transparency as significant issues. Some responses include:

“The biggest area for improvement is customer service. Too many banks do not pay any attention to good customer service for existing customers. New customers are always more interesting to them; this is, for me, a reason to look around and maybe switch.”

“Customer service needs improving. Large banks are getting further and further away from developing a relationship with small businesses.”

“Well, in a perfect world, they would be ethical, transparent, and honest — but sadly, we don’t live in that perfect world. So I would suggest eliminating most of their unnecessary fees and penalties, offer more/better rewards for longtime clients in good standing with the bank and offer a larger array of banking options.”

Access to credit is critical.

As small business owners face an uncertain economic future, access to capital like a line of credit is essential, and they expect to obtain that financing from their bank.

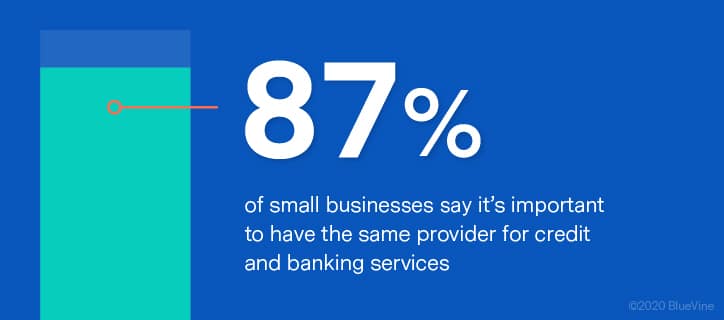

When asked how important it is to have the ability to access credit and banking services from the same provider, nearly nine in 10 (87%) of small business owners say it’s important, with 64% saying it’s very or extremely important.

Additionally, when asked about areas for improvement in business banking, many small business owners cited access to capital as a top concern, especially in today’s economic climate.

According to one respondent: “The current pandemic has highlighted one issue, and that is the importance of an [e]mergency fund. Therefore, the most important feature to any business banking is the availability of a line of credit from any bank.”

There’s a Better Way With Bluevine Business Checking

Bluevine was founded to serve and support small business owners—it’s in our DNA.

We’ve been there for small businesses since our inception in 2013, through our financing solutions. We sprung into action to support them through the Paycheck Protection Program, providing more than $4.5 billion to over 155,000 businesses. We’re also here for them now with hassle-free, monthly fee-free, high-interest checking to help them regain footing and reopen doors with confidence.

Bluevine announced Bluevine Business Banking with a checking account (beta) in October 2019, marking the industry’s first online banking solution built specifically for small businesses. The checking account serves the unique needs of small businesses, offering no hidden or monthly fees, 1.3% interestBVSUP-00005, and a mobile app for you to transact on the go. Bluevine Business Checking is paired with Bluevine Payments, which allows you to easily pay bills, vendors, or suppliers using your checking account or credit card.

Our vision is to provide small businesses with a seamless banking experience, integrated with deposits and payments, financing and credit, and software integrations. To join or learn more, visit: https://www.bluevine.com/business-checking/.