Funding is essential for a business to operate. That funding can be generated by revenue, but there are times when standard cash flow just doesn’t cover every need. Examples of this are product rollouts, expanding into a different market, or overcoming a tough financial situation. A business loan or business line of credit could be a solution in these circumstances.

What is a business line of credit?

A business line of credit works like a credit card. The lender approves your business for a specific amount of money, but you’re not required to take it all in one lump sum. Funds can be withdrawn as needed and your business line of credit can be reused if repayments are made to keep it below the pre-approved limit. Interest rates are typically variable, and some business lines of credit may require review and approval for each individual draw.

What is a business loan?

A business loan is a lump sum of money that your business borrows and pays back in equal monthly installment payments. The interest rate is normally fixed. Lenders approve business loans using both personal and business credit scores, revenue numbers from the business, and the financial reports and tax returns from previous periods.

What’s the difference between a business line of credit and business loans?

A business line of credit is more flexible than a business loan because your business is not required to take all the funds that you’re approved for in one lump sum. This makes a business line of credit a good option for short-term financial needs like getting through an offseason or launching a new product line. The funds can be paid back monthly, weekly, or all at once, like a credit card. Business lines of credit can also be a great security blanket in case of emergencies.

A business loan is more of a long-term financial obligation because your business doesn’t have the option of taking less than you’re approved for. The funds come in all at once and they’re paid back in equal monthly installment payments. Business loans are often taken out when a company first opens or when they’re planning a long-term growth campaign.

Which type of business financing should you choose?

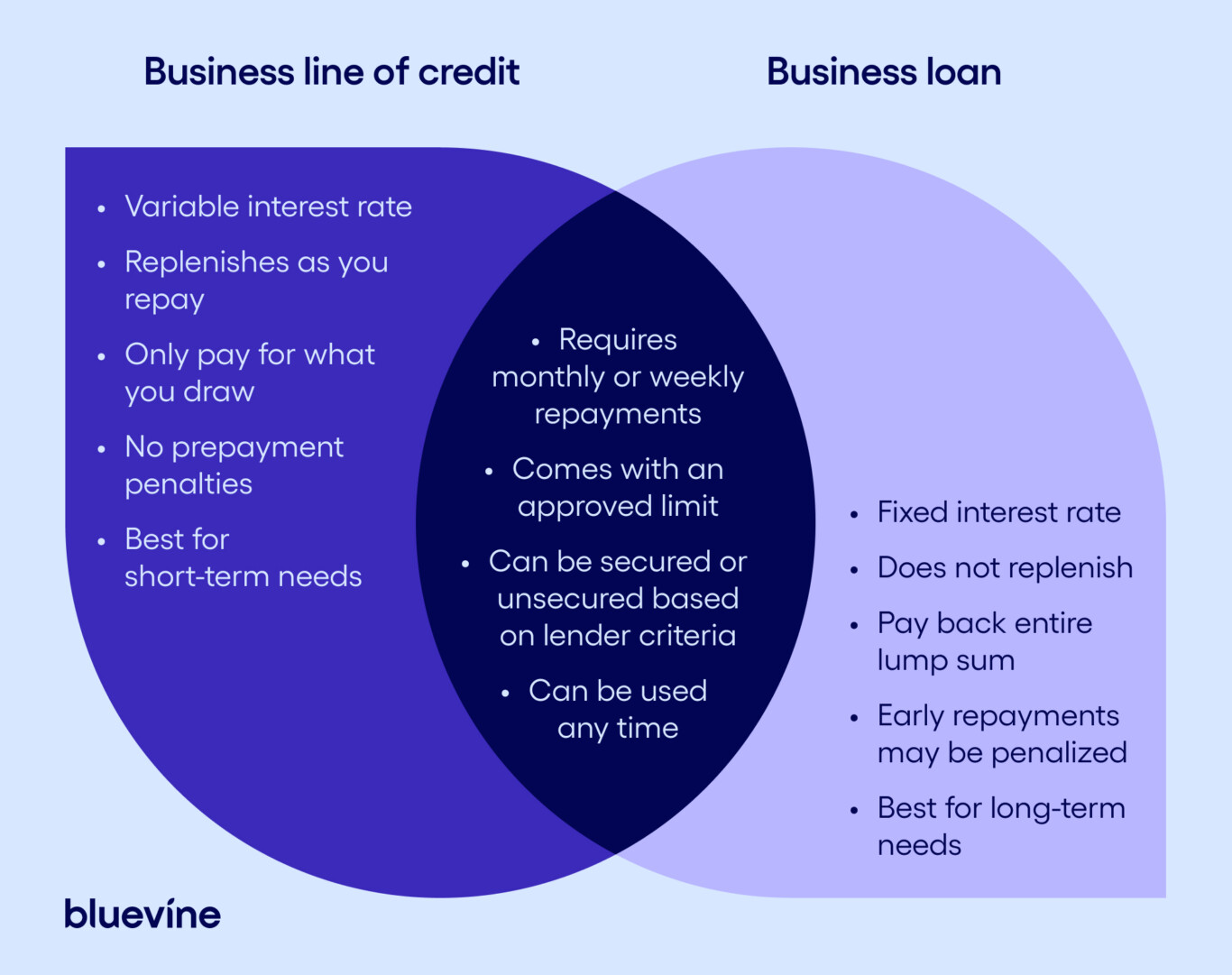

The visual above outlines the differences between business loans and business lines of credit. Use it as a guideline to decide which type of business financing is best for you. Another method is to evaluate how you’re going to use the funds. If your costs are going to be variable, a line of credit may be a better choice. A business loan might be more optimal for fixed, predictable costs and use cases.

A good example of this is a new marketing campaign. The cost will be low in the testing phase, but you’ll want to be able to crank it up if you get good results. That’s a perfect scenario for a business line of credit because the costs are variable. A business loan would be useful if you need to buy a set amount of new product to build up inventory.

How to get a business line of credit

Review your personal and business credit scores before you apply for a business line of credit. You should also gather your company’s financial statements, tax records, and proof that you’re an authorized officer of the business. Lenders who specialize in small business loans or a small business line of credit may require more personal information or a cosigner. Try to have one available if you have poor credit.

Learn more about the requirements for a Bluevine Line of Credit.