Everything we build at Bluevine starts with the goal of bringing the best financial solutions to small businesses like yours. The Bluevine Business Cashback Mastercard® is no different—we wanted to create a rewards credit card that’s simple to get, easy to use, and works seamlessly with the Bluevine Business Checking account.

As the product team lead for lending and credit, I’m excited to share an overview of what credit card features you can enjoy right out of the gate, what’s coming soon, and where we hope to go in the future to bring you the best business credit card experience possible.

What the Bluevine credit card offers today

We wanted to start simple and focus on the credit card features that we knew would be important to small businesses. That way, we could learn from our customers to see what we should build next. Here are some features Bluevine credit card customers can take advantage of to start.

Simple application and setup

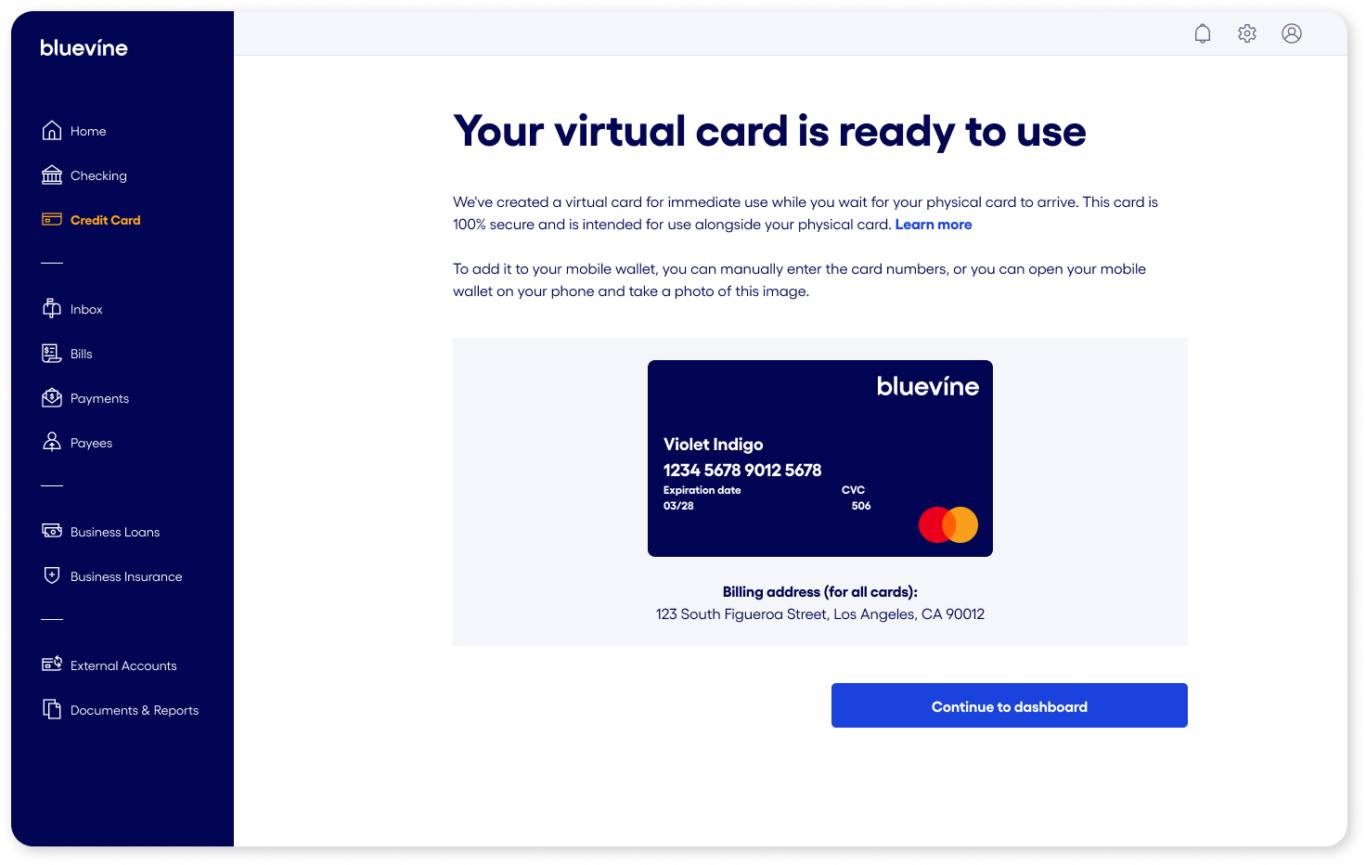

Knowing that time is one of the most valuable resources for a small business, we made our credit card application as simple and as fast as possible. If you’re already a Bluevine Business Checking customer, you only need to answer a few questions in your Bluevine dashboard to apply. Seconds later, we’ll let you know if you qualify for the Bluevine credit card—with no impact to your credit score. Once you accept your offer, setup is as easy as confirming your payment preferences. Then you can start using your virtual card to earn 1.5% cash back right away.BVSUP-00086

If you don’t have a Bluevine account yet, you can easily open a business checking account with us in just a few minutes. Then, if you qualify for the Bluevine credit card, we’ll invite you to apply and view your offer.

*Please note: Currently, the Bluevine Business Cashback Mastercard is available to Bluevine Business Checking customers through invitation only.

Cashback rewards and no annual fee

Your business credit card should reward you for expenses and bill payments, without unnecessary annual fees—similar to how your business checking account shouldn’t nickel-and-dime you with monthly fees. That’s why the Bluevine business credit card lets you earn 1.5% cash back on business purchases, with no annual fee.

Seamless integration with Bluevine Business Checking

Besides great cashback rewards and easy setup, the Bluevine credit card lets you view transactions in real time and manage your card status from the same dashboard or mobile app you manage your Bluevine Business Checking account. This makes it easy to pay off your balance using your Bluevine account or an external account.

Integration with accounting software

We’ve always known that integration with accounting software is important for small businesses, but at first we didn’t think it was critical to have on Day 1. However, our early credit card customers let us know loud and clear that they wanted and needed these integrations. Thanks to this great feedback, we listened and updated the Bluevine Business Checking account/Plaid connection to support the credit card.

Soon, we’ll be extending the QuickBooks Online integration so you can easily sync your Bluevine credit card data to your accounting software the same way you do with your Bluevine Business Checking account.BVSUP-00056

Order additional cards for your team

You can already issue physical or virtual cards to team members you’ve added to your Bluevine account. This means you can earn 1.5% cash back on all your business spend, even if it’s your team who’s doing the spending—allowing you to maximize your cashback earnings.

What we’re building next

From the beginning, we wanted our product roadmap to be driven by the needs of the businesses we serve. Customer feedback has proven to be an essential part of our building process, and we enjoy speaking directly with business owners like you to better understand how we can help.

We’re confident that these upcoming features will offer even more value for your business.

More ways to earn 2.0% APY on checking deposits

We offer a high annual percentage yield (APY) because we want you to earn it. Today, you can earn 2.0% APY on your Bluevine Business Checking balances by spending $500 a month with your Bluevine Business Debit Mastercard®.BVSUP-00005 Soon, you’ll be able to spend $500 a month between your Bluevine debit or credit card to earn 2.0% APY.

The future of the Bluevine credit card

There are many more features on the horizon for the Bluevine Business Cashback Mastercard. We will continue to provide updates on our roadmap and features here, and we encourage you to reach out directly if you have feedback or your own ideas on what you’d like to see from the Bluevine credit card. We’re eager to hear your thoughts on the product experience so we can continue to improve with businesses like yours in mind.