Update: Paycheck Protection Program has ended

It was our honor to have supported more than 300,000 small businesses with COVID-19 relief loans to help them cover expenses, pay employees and get back on their feet.

For the best tips on running and scaling your growing business, check out the latest on our blog:

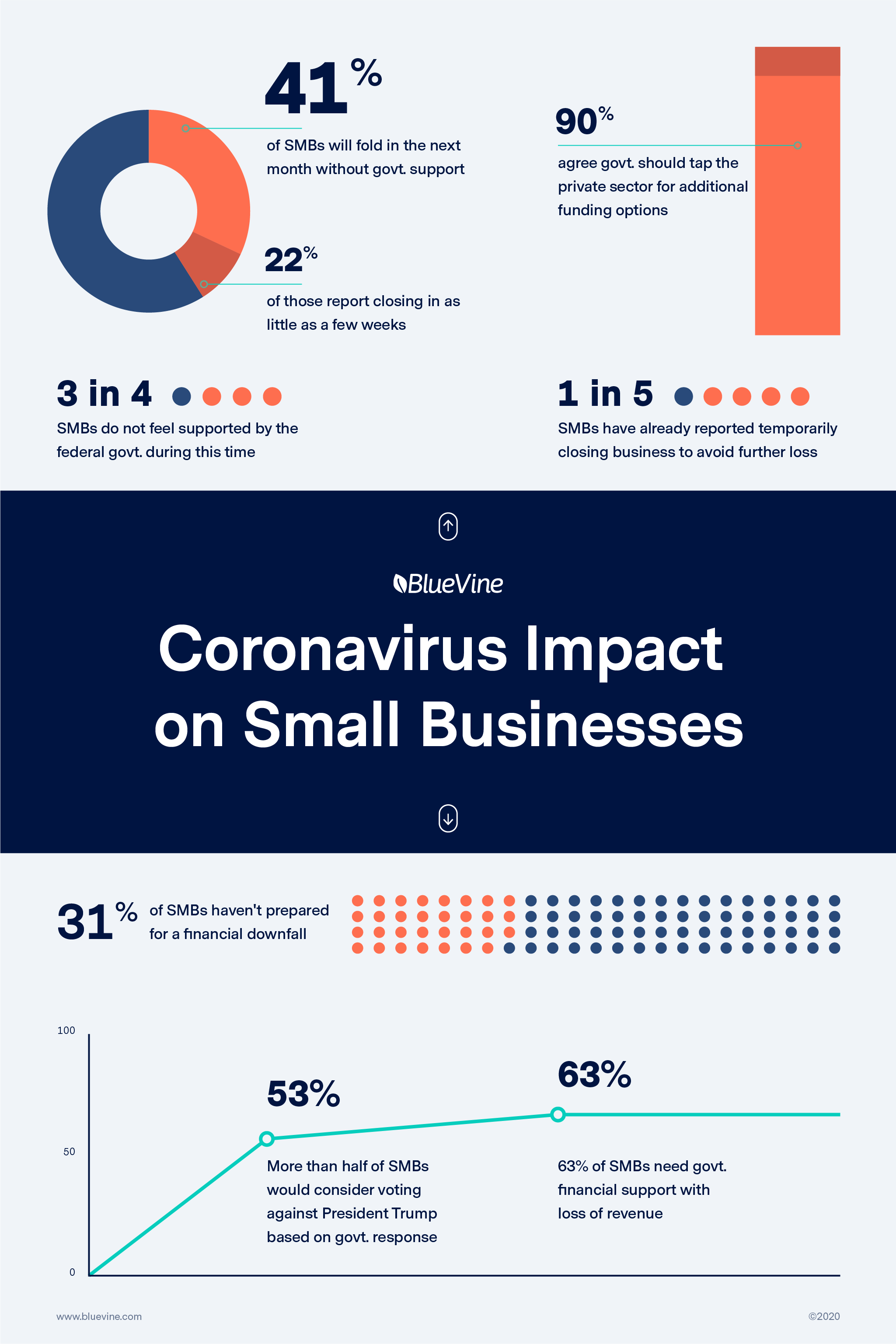

In late March 2020, the federal government approved a $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, the largest stimulus bill in U.S. history, to support entities affected by this pandemic and the suffering economy.

One of the bill’s measures that aids small businesses is the Paycheck Protection Program (PPP), available through Aug 8. This program will help businesses keep the lights on and workers employed.

Here’s everything you need to know.

About the Paycheck Protection Program

The Paycheck Protection Program (PPP) is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This $669 billion program provides eight weeks of cash flow assistance through 100% federally guaranteed loans to keep the small business workforce employed during the COVID-19 crisis. Eligible loans function as a non-taxable grant forgivable under certain circumstances. The latest government stimulus package commits $284.5B to PPP and allows for Second Draws and simplified loan forgiveness.

Key details

- The SBA’s Paycheck Protection Program now offers two loan options for small businesses: a First Draw for businesses that haven’t yet received a PPP Loan, and a Second Draw for businesses that did not receive a prior PPP Loan

- Loans are available up to 2.5x (3.5x for eligible Accommodation and Food services for Second Draw) average monthly payroll costs, with a 1% interest rate

- Businesses can use funds on payroll costs, including employee salaries, insurance benefits, insurance premiums, mortgage interest payments, rent and lease payments, certain property damage, essential supplier costs, worker protections, and utility expenses

- Per SBA program rules, payroll costs must account for 60% of expenses to qualify for forgiveness

- There are no payments for the first ten months

- There are no additional SBA fees or need for collateral or personal guarantees

Who qualifies for the PPP?

The primary requirement for First Draw loans is that a business needs to have fewer than 500 employees who reside in the U.S. Here’s the breakdown of entities that qualify for a First Draw PPP loan:

- S corporations, C corporations, and partnerships

- Sole proprietors and single-member LLCs

- Independent contractors

- Restaurants, hotels, or businesses under “Accommodation and Food Services”

- Nonprofit (501(c)(3) organizations

- Veterans 501(c)(19) organizations

- Tribal businesses meeting the SBA’s size standard

- Housing co-ops with fewer than 300 employees

- Certain broadcast and news organizations

- Destination marketing organizations

- That generally don’t engage in lobbying

- With fewer than 300 employees

Second Draw eligibility differs from First Draw and requires businesses to meet additional criteria. Here are the main differences:

- The business must have fewer than 300 employees

- The business must demonstrate a 25% loss in revenue over a certain period

- The business must have received the First Draw in compliance with eligibility requirements

- The business must have used, or will use, its full First Draw amount (including any increases) on eligible expenses

The SBA applies detailed affiliation requirements that request a business aggregate all of its parent companies, affiliates, and subsidiaries to determine whether the business meets the small business size requirements and borrowing criteria. You can view the full list of affiliate rules for this program on the SBA site.

How much funding a business can receive

The PPP loan amount a business will qualify for depends on its monthly average payroll costs. Use the timeframe recommended below (based on the applicable entity type) to calculate monthly average payroll costs.

- U.S. small businesses: The applicable period for an established small business is (1) calendar year 2019 or (2) calendar year 2020. If the entity is not self-employed, it may also use the prior 12 months

- First Draw, new small business: Businesses formed after Jun 30, 2019, that apply for First Draw may use one of the above methods, or Jan 1, 2020, through Feb 29, 2020 (2 months)

- Second Draw, new small business: Businesses not in operation for all of Feb 15, 2019, to Feb 15, 2020, should use all of the months in operation from 2019 through the end of 2020 to determine their average monthly payroll

- Seasonal businesses: The applicable period for a seasonal business that only operates during certain parts of the year is any 12-week period (at the applicant’s discretion) between Feb 15, 2019, and Feb 15, 2020

Not an employer: The applicable period is a full 2019 calendar year unless you are a seasonal business or new business. Sole-proprietors report income on Schedule C (line 31). If you’ve filed Schedule C and 944 forms, add line 31 from Schedule C to lines 1 and 2 from the 944 form

Here’s how to calculate your PPP loan amount:

Take your average monthly payroll cost and multiply it by 2.5 (3.5 for Second Draw eligible food and accommodation services); this number is the maximum loan amount, up to $10 million for First Draw and $2 million for Second Draw. If referring to the annual payroll costs, divide the annual number by 12 to determine the monthly average payroll cost.

What you can use funds to cover

For loan forgiveness to occur, businesses have to use the funds on payroll costs, insurance premiums, mortgage interest payments, rent payments, and utility costs. The costs need to occur during an 8 to 24 week period after receiving the loan (while maintaining employee numbers and compensation levels).

It’s important to note that insurance premiums and mortgage interest payments must be incurred by Feb 15, 2020, for loan coverage eligibility. Similarly, rent lease agreements and utility services must be in place before Feb 15, 2020.

The SBA released a simplified forgiveness application. We’ll provide more information on the application (as well as the rules for loan forgiveness) when available.

Defining eligible and ineligible “payroll costs” for forgiveness

Payroll costs include:

| Forgiveness eligible payroll costs | Non-eligible payroll costs |

|---|---|

|

|

BLUEVINE TIP

Keep a documented record of all of your expenses because you’ll need them when seeking SBA’s loan forgiveness through your lender.

What you need to know

We understand this is a difficult time for everyone, and we’re committed to helping business owners with government emergency relief resources and clear steps.

Bluevine is an official direct non-bank lender for the government-backed SBA Paycheck Protection Program. Our entire PPP application process, including retrieving your loan number, is automated and online. Get started with a fast and secure online PPP loan application.