As a small business owner, you might pay your bills using checks or ACH transfers, which are both great options. If you use a bill pay platform to manage all your bills from the same place, you likely schedule payments in advance, especially for recurring monthly bills.

But, as convenient as check payments and standard ACH are, sometimes you may need to hold on to cash a little longer. For those instances, same-day ACH payments could be the perfect payment option to free up your cash flow.

What is an ACH payment?

An ACH, or Automated Clearing House, allows banks to transfer funds electronically through batch processing, which is quicker and less expensive than matching every payment individually. It has become the norm for Federal Reserve banks and other financial institutions to move money between accounts.

When a new employee or vendor is told they’ll be paid via ACH, it’s received as good news. It means instead of funds taking a few days to settle, which can lead to payroll or invoices being paid late, funds can now be settled as soon as the same day.

For example, if you own or manage a young company that must pay for materials before or upon delivery, ACH payment for bill pay between you and your supplier keeps you amply supplied and your vendor promptly paid, which is essential to the development and long-term health of your business relationship.

5 benefits of using ACH to move money

An ACH payment, in general, has a substantial number of benefits compared to other payment methods:

- Lower transaction costs – ACH transaction costs vary by processor and bank but typically cost less than credit card transactions and wire transfers.

- Recurring transactions – ACH helps automate and speed up accounts payable and reduces concern over missed payments. The cost of reminding customers to pay is also eliminated.

- Reduced payment failures – Credit cards are often lost or stolen and have expiration dates, each of which can result in payment failure. ACH payments don’t carry those risks, only the risk of insufficient funds.

- Security – Recurring ACH payments, such as direct deposits of paychecks into employees’ accounts, are much more secure and accurate than manually writing checks during each pay period. ACH also prevents misused credit cards and inaccurate wire transfers. Plus, the theft of cash is mitigated.

- On-time payroll – The continued loyalty of your employees is dependent upon many things, including being paid on time so they can meet their financial obligations. This can sometimes be challenging for newer small businesses. Same-day ACH, specifically, helps ensure your employees get their money on payday.

What’s the difference between ACH and same-day ACH?

Whereas regular ACH means payments are settled at multiple points during the week, such as every 1–2 days, same-day ACH means banks settle on the same business day.

Same-day ACH can help you hold on to your cash longer and pay your invoices at the last minute, which can be critical to a small business’ smooth and continuous operation.

Why use same-day ACH payments?

If you need to send and receive expedited payments, same-day ACH can be a business saver. It benefits companies by:

- Paying bills faster

- Increasing and improving cash flow

- Maintaining solid vendor relationships

- Ensuring employees are paid correctly and on time

Same-day ACH also benefits employees by giving them:

- Freedom from the inconvenience of dealing with a paper check. Even if deposited by the employee via a banking app, check funds may not be available for 1–2 business days.

- Immediate access to final wages if terminated, instead of the employer needing to mail a final check to the terminated employee’s home or forcing the employee to return to the office to pick up their last check.

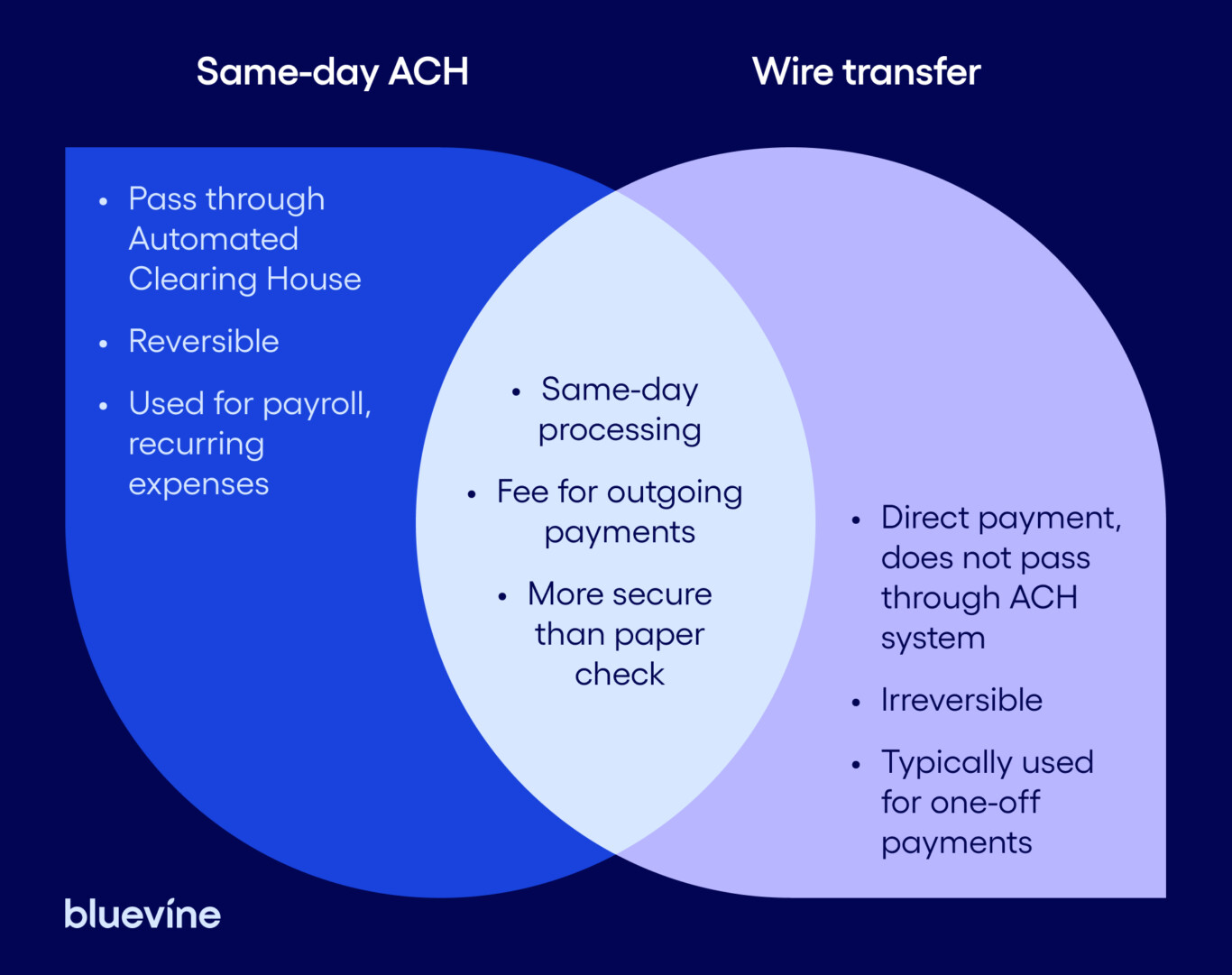

Same-day ACH vs. wire transfers

Wire transfers are a means of sending money from one bank account to another. There may be fees charged for each transfer to both the sender and receiver of the payments, depending on the bank. The amount of the fee is also based on whether the transfer is incoming or outgoing, and whether it’s a domestic or international transaction.

Here’s a helpful comparison between same-day ACH and wire transfers: