When you first start a business, it might make sense to use your personal checking account for business purposes. On one hand, personal checking accounts typically have fewer fees and requirements than business checking accounts. On the other hand, you might think that a business checking account is unnecessary when you’re just starting out, especially if you’re a sole proprietor, entrepreneur, or freelancer working from home.

In actuality, setting up a business checking account right away gives you added protection and flexibility so you can run and grow your business on your terms—regardless of the size of your business, your incorporation status/entity, or whether or not you have a traditional office.

If you’re using a personal account now, you can easily switch to a business checking account and reap all the benefits it affords business owners like you. To help you get a lay of the business checking land, here is a breakdown of why and how to separate your accounts.

How does a personal checking account differ from a business checking account?

Personal and business checking accounts are very similar in nature—both types of checking accounts allow you to deposit and withdraw money, make ACH or check payments, and use debit cards for purchases and withdrawals—but there are a few key differences:

Personal checking:

- Uses an SSN. Individuals must provide their social security number to open a personal checking account.

- Are free to open. Generally speaking, it doesn’t cost anything to open a personal checking account.

- Come with some liability. If used for business purposes, personal accounts may leave an individual’s personal assets at risk.

Business checking:

- Often uses an EIN. Though not always the case (such as if you’re sole proprietor) most business accounts are opened by a legal business entity, such as an LLC, using a federal EIN (or employer identification number).

- Sometimes carries fees. Many business checking accounts come with maintenance fees (some of which may be hidden account fees you don’t realize you’re paying up front) and/or minimum requirements.

- Offers liability protection. With a business checking account, your personal assets are protected from liability relating to your business’s financial obligations.

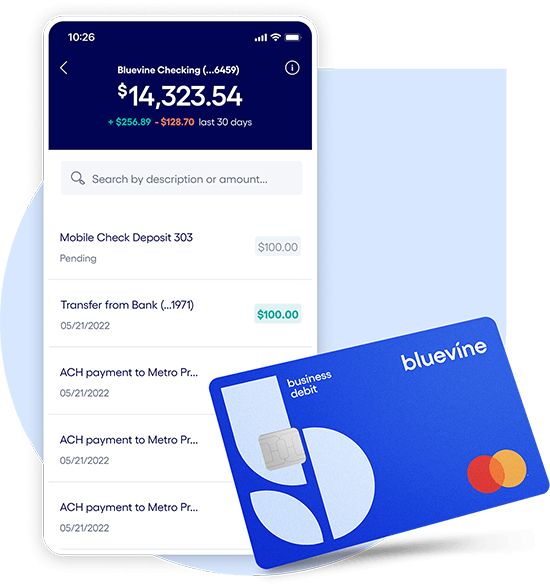

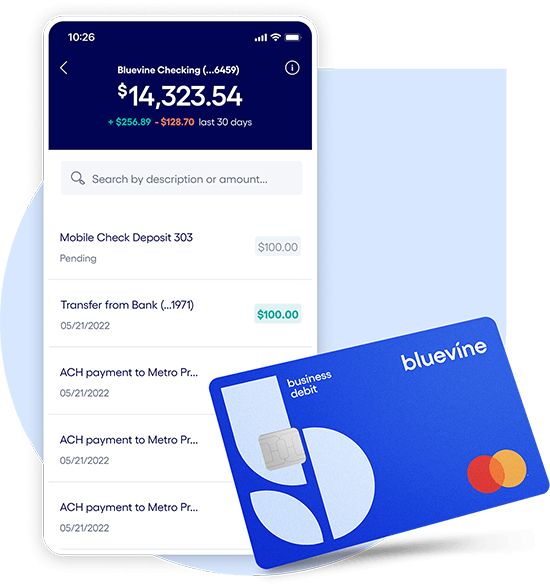

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more

Can you use a personal checking account for business?

If you’re a sole proprietor, you technically and legally could use a personal checking account for business, but there are a couple of things to consider before you do:

- Your bank might have certain terms and conditions that prevent you from using a personal account for business purposes.

- You’ll have to manually separate business and personal expenses come tax season, which could lead to inaccurate filings (and time spent away from your business).

What are the benefits of a business checking account vs. personal bank account?

While it might be tempting to run your business without setting up a separate checking account, there are a number of benefits that come with dividing up your personal and business accounts. These include:

- Tax simplification: With a small business checking account, your business expenses will be easier to identify and track, and the IRS will be more likely to accept certain deductions if they are associated with a business account.

- Liability reduction: If someone tries to sue your company, courts will only go after your business assets. This is because they consider corporations to be separate from the individual owner(s), and it will be clear what constitutes those assets in a business checking vs. personal checking account.

- Growth flexibility: Having a legitimate business entity signals to the credit bureaus that it’s time to start building business credit, which could help you get the right financing to invest in growth.

- Subaccounts: You’ll be able to open accounts for employees that may incur business-related expenses.

- Fee friendliness: Many online and alternative banks have emerged that charge minimal to no business banking fees.

- Credibility: A business account can help legitimize your business. Having business checks with your business not only looks more professional to vendors but also builds your business brand.

- Account integrations: Easily connect to other accounts — like a business line of credit or credit card — to make transfers or payments.

When is the right time to open a business checking account

Ideally, you’d open a business checking account before you officially launch your business. That way, your business finances (and legal protection) will be in place from the start.

This goes for all types of businesses—even if you’re a sole proprietor who works from home. The last thing you want to do is risk losing your personal assets due to an unforeseen legal issue.

How to separate personal checking and business checking accounts

Opening a business bank account as a sole proprietor might require you to actually incorporate and get an EIN. We recommend discussing your options with your accountant and/or legal advisor if that’s the case.

If you’re already incorporated, your first step is to find a business checking account that fits your needs, which brings us to the next section.

What should I look for in a business checking account?

When it comes to business banking, you want to be able to protect your personal assets and have added flexibility and convenience as you grow. Personal checking accounts can’t offer this.

Here’s what to look for in a business checking account compared to a personal checking account:

- No fees: That includes hidden fees, monthly service fees, ATM fees, and non-sufficient funds fees.

- Unlimited transactions: You want an account that gives you the ability to make as many deposits and withdrawals as you need.

- No balance requirements: Look for an account that doesn’t require you to have a minimum balance.

- Easy payments: Pick something that facilitates easiy vender and bill payments by ACH, wire, or check — and schedule one-time or recurring payments as needed

- Mobile-friendliness: Go with an account that allows you to easily manage banking, check balances, make payments and transfers, etc. from a mobile device

- High APY: Ideally, you should look for something that offers higher interest rates than the national average, which is 0.1%.

- Dedicated support: Whether it’s a dedicated member of your local bank branch or an actual person on the phone, you’ll likely need real, live support from time-to-time.

Bluevine’s business checking account, which was built with sole proprietors in mind, checks all these boxes.

What do you need to open a business bank account?

Opening a business checking account requires more documentation than a personal account. Here’s what you might need:

- Social Security number if you are a sole proprietor

- Employee Identification Number (EIN) if your business is a corporation, partnership or limited liability company (LLC)

- Government-issued ID, such as a driver’s license or passport

- Business license and Articles of Organization (for LLCs) or Articles of Incorporation (for corporations)

- Organizing documents filed with the state

- Partnership agreement with the name of the business and its partners (for a business with multiple owners)

- Certificate of assumed name/Doing Business As (DBA) name, if applicable

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more