Bluevine has been named one of the top financial technology companies in the Bay Area by the San Francisco Business Times, highlighting a solid year for the Silicon Valley startup.

“Financial technology continues to be a hot space for emerging Bay Area companies,” the San Francisco Business Times said in a report. “In fact, our third annual ranking of the 50 largest local fintechs, based on size of Bay Area workforce, features 11 new companies that didn’t appear on last year’s List.”

One of them is Bluevine which joined other fintech pioneers, including Intuit, PayPal and Square.

“We’re truly honored to be on this list,” Bluevine CEO Eyal Lifshitz said. “Fintech companies are dramatically changing the way small and medium-sized businesses access capital and we are excited to be part of that journey.”

Solid Momentum as FinTech Pioneer

Being named to the Bay Area Top FinTech list underscores Bluevine’s growing momentum as an online provider of fast and flexible working capital financing to small and medium-sized businesses.

Bluevine just marked the third year of its cloud-based platform, which has helped thousands of entrepreneurs get quick and easy access to everyday financing through business lines of credit and invoice factoring.

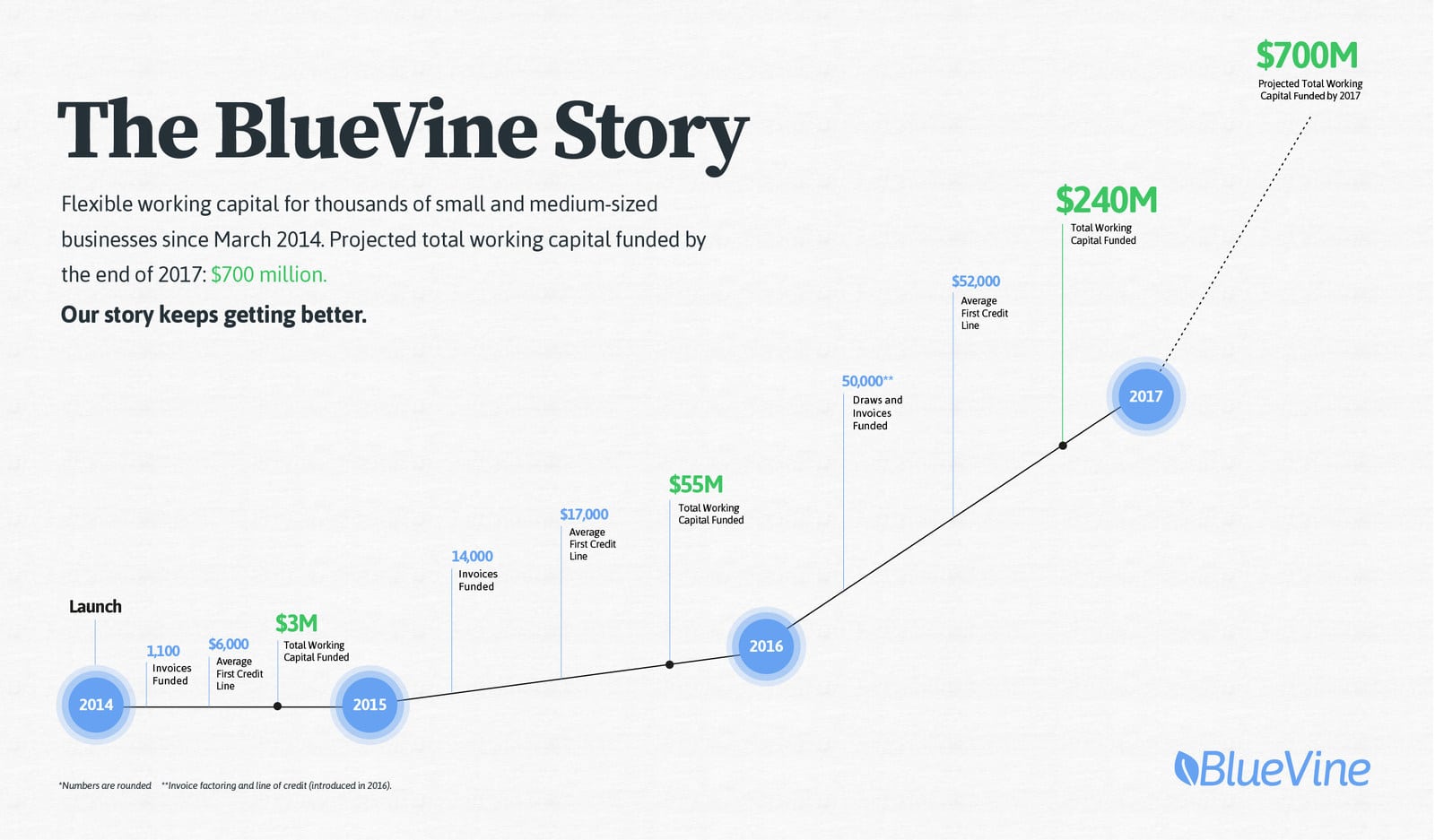

Bluevine was founded in 2013 and launched its financing platform in March 2014 with an innovative 21st century version of invoice factoring. Invoice factoring, which dates back to the Babylonian Age, allows businesses to access capital trapped in unpaid invoices. In April 2016, Bluevine introduced a business line of credit solution called Flex Credit.

“The inspiration for Bluevine came from my dad, who also struggled with cash flow as a small business owner,” Lifshitz said. “It’s very rewarding to provide a service that has helped thousands of small business owners solve this common problem. I’m so proud of our team’s efforts over the past three years to build the fastest, most convenient way for entrepreneurs to get funding to run and grow their businesses.”

Bluevine has built a reputation as a trusted small business financing partner with fast funding and transparent terms over the past three years.

$700 Million in Working Capital Funded

Bluevine is currently the only company offering a 100 percent online invoice factoring service, which allows for rapid advances on outstanding invoices due in 7-90 days. Bluevine Flex Credit product has expanded the company’s ability to offer convenient access to working capital.

Bluevine financing has expanded dramatically in three years. The company had funded around $200 million in working capital in 2016. The company expects to double that in 2017 alone, and is on track to fund approximately $700 million since inception.

Bluevine also has broadened its customer reach to include businesses in a wide range of industries, including retail, IT services, business services, media and entertainment, engineering, construction and others.