Having extra cash on hand is crucial for businesses of all sizes—whether you’re looking to expand operations, cover an unexpected cash flow gap, or capitalize on a seasonal opportunity, a business line of credit is a reliable, long-term way to get that cash when you need it.

In fact, business lines of credit are one of the most popular choices among business owners who apply for financing, but how easy is it to actually get one? Your chances of getting approved mostly depend on just a few things. Most lenders require you to be in business at least two years and present a strong business credit profile. Larger or lower-interest lines of credit will have stricter conditions, and may require collateral.

This may seem daunting, especially if you’re a startup that needs a line of credit. Thankfully, applying online has never been easier—we’ve laid out five straightforward steps for how to get a line of credit for your business.

What you need to know

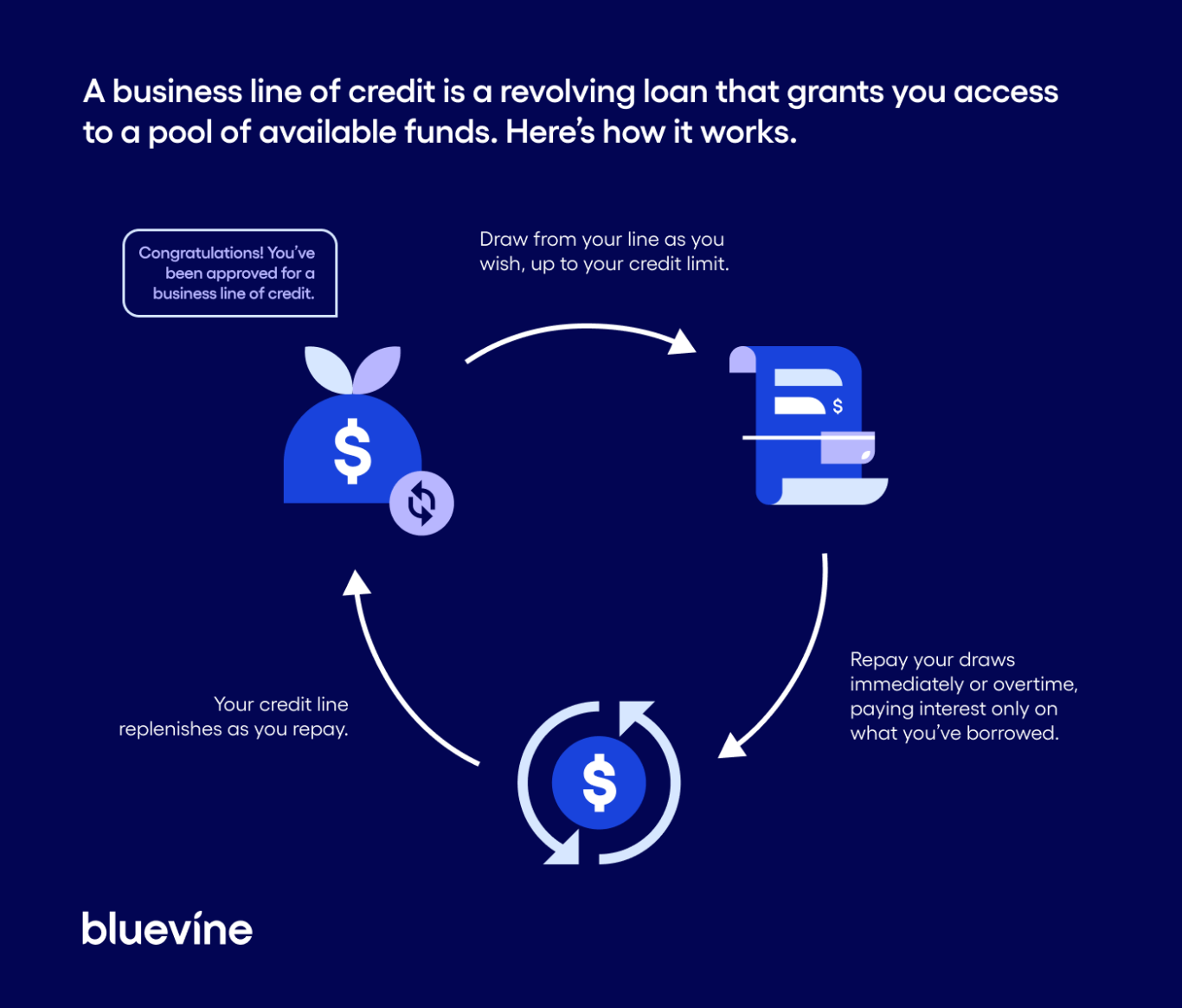

- A business line of credit is a pool of funds that replenishes as you repay your draws.

- They’re a flexible, affordable form of debt financing for covering ongoing expenses such as rent, payroll, or inventory, or for taking on new projects or expansion opportunities.

- To apply, review your finances, research different types of lenders and loans, and apply online. If a line of credit isn’t right for you, consider a term loan or SBA loan.

How does a line of credit work?

Secured versus unsecured business lines of credit

If you’re an established business with a strong credit profile, you may face a choice between a secured or unsecured line of credit.

- Secured lines of credit require you to post collateral, like property or ownership equity, which you agree to forfeit if you can’t repay the loan. Because the risk to lenders is lower, you’ll receive more favorable terms, like a higher credit limit and lower interest rate.

- Unsecured lines of credit don’t require you to post collateral, so the risk to you is much lower. Because the risk to lenders is higher, you’ll receive slightly less favorable terms, like a lower credit limit and higher interest rate.

Do you need a business line of credit?

A business line of credit is a uniquely flexible form of financing for businesses to cover expenses and finance growth opportunities at every stage of business growth. They’re also more affordable than other types of debt-based financing—interest rates are low, and you only pay interest on the amount you draw.

So, if you need funds to pay rent, cover payroll, purchase equipment, or take on a new project, a business line of credit can create an affordable cushion of working capital.

How to apply for a business line of credit

You’ve assessed your business needs and determined that a line of credit would boost your growth. What’s next?

1. Review your credit score and finances

Most lenders have similar minimum requirements. To see if you’re qualified for a business line of credit, make sure the following applies to your business:

- 625+ FICO score

- In business for 2+ years

- No bankruptcies for the past three years

- Strong business credit profile. Lenders will look at your personal and business credit scores to gauge the creditworthiness of your business. The stronger your scores, the more options you have. You can build business credit by making consistent, on-time payments on recurring bills and debts.

- $40,000 in monthly/annual revenue. To determine whether you can pay back your credit line, lenders will forecast your cash flow based on your monthly statements. Lenders also want to see consistent annual growth, so they can increase your credit line as you grow your business.

2. Compare your options

Once you’ve confirmed that you qualify for a business line of credit, your next step is to understand the pros and cons of each type of lender.

- Traditional bank lines of credit offer favorable terms and low interest rates, but also have stricter requirements and thorough applications. Contact any banks you have an existing relationship with to see if you qualify.

- Online lenders offer shorter applications, more lenient requirements, and faster approval, but with slightly higher interest rates. Online lenders are generally the most accessible, requiring only a phone or computer for all financial services and 24/7 access.

- Credit unions are member-owned and non-profit, which means lower rates and favorable terms for lending customers who join, but also fewer branches than traditional banks. Some credit unions are community-based, which requires you to live within a certain area, and others are occupation-based.

3. Gather required documents and submit your application

While hunting for business lines of credit to apply for, compare terms, rates, and requirements across different types of lenders. Once you’ve chosen a few potential lenders, gather your documents so you can fill out your application in one sitting. It’s important that you only submit one application at a time (decisions are almost always made within a few days) and don’t open more than one credit line.

Here are some of the documents and information you’ll be expected to submit to a lender:

- Personal information: To verify your identity, lenders will require you to submit information about yourself. This includes your full legal name, social security, criminal record, and educational background.

- Bank statements: Many lenders require at least one year of bank statements.

- Financial statements: To determine the financial strength of your business, you’ll need to submit documents such as your profit and loss sheet, cash flow sheet, and balance sheet.

- Information about other stakeholders: If you own less than 50% of the business, you must provide information about any additional stakeholders.

- Legal documents: Depending on the lender you apply to, you’ll be expected to submit one or more of the following: business licenses and registrations, articles of incorporation, business tax ID, contracts with third parties and/or UCC filings.

- Debt schedule: If you have any existing debt, some lenders will expect you to provide a debt schedule. This shows all your business’s outstanding loans, credit, and payment schedule.

- Tax returns: Lenders will require you to show personal and business income tax returns over the last three years.

Once you’ve prepared all your documents, complete the lender’s application online (or in person if no online option is available). Some lenders conduct a hard credit inquiry that could briefly affect your credit score.

4. Review the offer and negotiate terms

Your application is unlikely to get rejected if your business meets all the lender requirements. Once approved, review the terms of the credit line offer, like your credit limit, interest rates (are they fixed or variable?), fees (see details below), repayment schedule, and any late payment penalties. Before accepting, negotiate terms so your line of credit can best benefit your business, particularly if you have above-average financials or competitive offers from other lenders.

5. Know the total cost of interest and fees

There are many different fees associated with a business line of credit. It’s important to understand the full amount you’ll be paying to the lender to avoid costly impacts to revenue or late payments. To start, your simple interest rate is the interest you’ll pay on top of the loan amount. So if you draw $10,000 with a 1% simple interest rate, you’ll repay $10,000 plus $100 in interest fees.

Here are some of the most common fees that lenders charge to use a business line of credit:

- Draw fees are charged on each draw you make, and cost between one and two percent of the total draw amount.

- Late fees are charged when you fail to make a payment on time, and can cost between $20-50.

- Maintenance fees are charged monthly to cover the lender’s costs of keeping your line of credit open.

- Annual fees are flat fees charged once per year. These can be used as maintenance fees or as an admission fee for premium financial service.

- Prepayment fees are charged if you pay your draws off early, and range from 3–5% percent of the loan amount. Online lenders usually don’t charge prepayment fees.

- Origination fees are charged when the line of credit is opened.

Apply for a Bluevine Line of Credit in minutes to get financing that’s tailored to your business needs.

Avoid common line of credit application mistakes

Know why you need the funds

Lenders want to see that their financing fits into a long-term growth strategy for your business. When applying for a business line of credit, come prepared with a plan that demonstrates how you’ll use the funds. Forecast your cash flow and the returns from any investments to help choose the right loan size.

Don’t take out more than one business line of credit (also known as loan stacking), and don’t draw more than you can afford to pay back. When you consistently make repayments on-time, your business credit profile will improve, and you’ll be eligible for larger credit lines and other business loans.

Get help understanding the application

Small business owners wear many hats. In an emergency situation, it may be tempting to rush through as many credit line applications as possible, but this can hurt your chance to obtain financing. From typos in your information to misunderstanding different rates and fees, simple errors can cause large problems. Hire an accountant or bookkeeper to help compare line of credit terms.

Need accounting help?

Bluevine partners with a network of accountants and bookkeepers who specialize in small business finances. Browse our directory here.

Be honest

You may be tempted to understate any financial problems on your application, but this is a bad idea. Lenders read business plans and assess lending risk professionally—they understand that sometimes businesses require outside funding to grow, and how much outside funding is too much for your company to rely on. They will also find out through their underwriting process whether you’ve misrepresented your finances, which will damage your chances of getting approved.

Business line of credit alternatives

If you don’t qualify for a business line of credit, or your business needs demand a different type of debt financing, you can try the options below:

- Term loans are a lump sum of funds paid upfront and repaid monthly over three to six years. They can be secured or unsecured. Business term loans are ideal for projects that require a large sum of cash upfront, whereas lines of credit are better suited to ongoing funding needs.

- SBA loans are unsecured loans administered through the U.S. Small Business Administration, ranging up to $5 million. Just enter your information on the SBA website, where you’ll be matched with one of the SBA’s partner lenders.

- Business credit cards are simply credit cards that are issued to your company instead of you. These offer an easy way to separate your spending and earn cash back and other rewards—plus all fees, finance charges, and interest paid are tax-deductible. Many business credit card issuers also allow you to issue additional cards to your employees, so you don’t have to exchange physical cards to make purchases.

Business line of credit FAQs

A secured line of credit requires collateral—private property or assets which you agree to forfeit if you can’t repay the credit line. Because the risk to the lender is lower, you can usually access much higher credit limits at lower interest rates, all while meeting lower requirements. As long as your business is able to repay the balance, secured lines of credit are a great way to quickly access capital. Mortgages and auto loans are common examples of secured loans.

An unsecured line of credit doesn’t require collateral. Because the risk to the lender is higher, you usually need to meet higher requirements for a smaller credit line and higher interest rates. If you don’t have collateral to offer or just want a less risky line, an unsecured line of credit is the safer option. Examples of unsecured credit or loans include credit cards and student loans.

A line of credit isn’t necessarily better than a term loan, but its flexibility may be a better fit for your business.

A term loan provides you with a lump sum of funds, which means you start repaying the entire amount plus interest immediately. With a business line of credit, you’ll only be responsible for repaying what you’ve borrowed, not the entire credit limit. Plus, as you make repayments, your line replenishes so you can borrow more funds, whereas with a term loan you can’t access more funds until you’ve repaid the lump sum.

When you apply for your line of credit, you’ll be responsible for supplying documentation for each of these requirements:

625+ FICO score

In business for 2+ years

$40,000 in monthly revenue

In good standing

No bankruptcies for the past three years

You can apply for a line of credit as an LLC as long as you’ve established a solid business credit profile—a 625+ FICO score, being in business for at least two years, in good standing, and with no recent bankruptcies the past three years, and earning $40,000 or more in monthly revenue.

Next, you’ll need to gather the necessary documentation for the application—this includes official documents with basic information about you and your business, and a bank connection or bank statements for the past three months to one year.

You won’t be able to get a business line of credit until you’ve established your business credit profile, but you may be able to apply for a personal line of credit, SBA microloan, or business credit card to fund the early stages of your business.

With a term loan, you’ll receive a lump sum of money up front that you have to pay back over time. A line of credit is a long-term pot of money, which you can take from whenever you want (up to your credit limit) and replenishes as you repay what you took plus interest.

Business term loans are useful for specific projects that need an upfront investment, but a business line of credit is more flexible and cost-effective—you’ll pay less to have quicker access to funds. Lines of credit will also better equip your business to grow long-term, since you won’t have to apply for a new loan whenever you experience periodic dips in sales or temporary emergencies. (Some credit lines do require approval for each draw, but these approvals are quicker than re-applying for a loan.) Repaying a line of credit will also help you consistently build your business credit history.

If a revolving business line of credit isn’t right for you, there are other types of debt financing that may better suit your business needs.

Term loans are a lump sum you receive upfront and repay in fixed installments over several years. If you’re willing to post collateral, you may get approved for a larger secured term loan with a longer repayment period.

SBA loans are unsecured loans issued by the U.S. Small Business Administration, via its lending partners. These can provide you with up to $5 million.

Yes! Traditional and online lenders offer online applications, and these are a great option for business owners looking to save time on the application process. If you’ve prepared all your documents already, applying online should take five minutes at most to complete. The process will follow these steps:

1. Go to your lender’s website and click the link to their line of credit application.

2. Fill out the application and upload your documentation.

3. Once you’ve submitted an application, you should get a decision within one to two business days.

This article was originally published on Dec. 28, 2016. It was updated on November 22, 2024.