Business checking

built for you.

Power your business with up to 4.0%

APY,BVSUP-00147 FDIC protection up to $3 million,BVSUP-00108

and no monthly fees.BVSUP-00122

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank,

Member FDIC, and our program banks.

Business banking that gets you

more for your money.

Save on fees, protect your money, and earn high-yield interest on your checking balances—

no need to move cash around.

Save with no

monthly fees.

Enjoy no monthlyBVSUP-00122 or overdraft fees, no minimum balance, free standard ACH, and unlimited transactions.BVSUP-00043 Our most active customers save $500/year in fees.BVSUP-00080

Earn high interest

on checking.

Get 1.5% APY with our Standard plan if you meet a monthly

activity goal. Or, earn up to 4.0%

APY with an upgraded plan.

FDIC insurance up to $3M.

Your account is FDIC-insured up

to $3 million per depositor

through Coastal Community

Bank, Member FDIC and our program banks.BVSUP-00108

Sign up for our Plus or Premier checking plans to get up to

4.0% APY and discounts on most Standard payment fees.

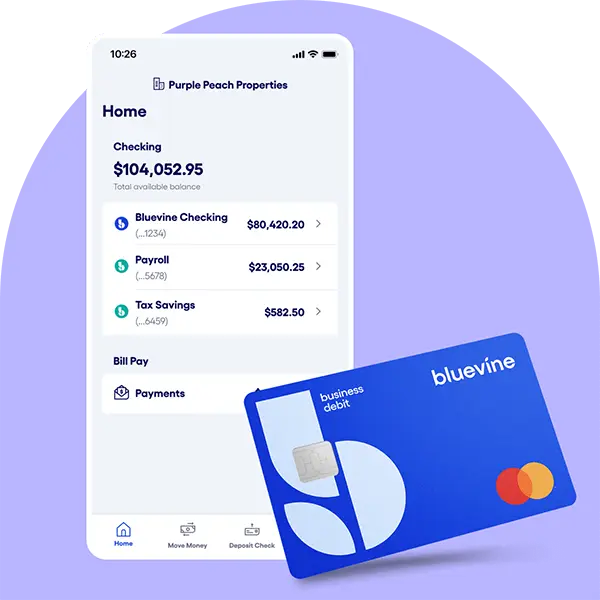

Run your business from anywhere.

Never step foot in a bank again with easy-to-use digital banking tools.

Mobile check

depositSkip a trip to the bank and easily deposit checks from your phone when you’re at home, in the office, or on the go.

Automated accounts

payableManage bills from one online platform and send money via same-day ACH, free standard ACH, check, and domestic or international wire.BVSUP-00137

Account access

for your teamSecurely share access with your team or accountant by giving each a dedicated login for a smooth online banking experience.BVSUP-00076

Multiple

sub-accountsOrganize your money the way you want by adding up to five sub-accounts. Plus, set automatic transfer rules to help manage cash flow.

Debit cards for you

and your teamIssue physical and virtual debit cards with daily and monthly spending limits to trusted employees, and earn 4% cash back on business purchases through Mastercard Easy Savings®.BVSUP-00083

ACH fraud protection

Block ACH debits from your main account and sub-accounts, or from specific payees. Plus and Premier customers can also preauthorize specific payees to debit from blocked accounts.

Bank with confidence.

The expert support

you needGet customer support when you need it from

real people, ready to help.Advanced security

featuresProtect your money and information with

two-factor authentication, data encryption,

and text alerts.BVSUP-00084$3 million in

FDIC coverageKnow your business checking deposits are

safe up to $3 million.BVSUP-00108

See why our customers

love Bluevine.

And why you will, too.

I searched far and wide to find an effective and simple business banking solution that met my business needs and I found that in Bluevine. Their integrations and no fee structure were selling points for me.”

Logan P.

LP Creative Media

Professional services

Read the storyOnline business checking FAQs

Eligible customers can earn up to 4.0% annual percentage yield (APY) on their checking balances.

With our Standard plan, you can earn 1.5% APY on balances up to $250,000 when you meet one of the following monthly eligibility requirements:

- Spend $500 per month with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard

OR

- Receive or deposit $2,500 per month in customer payments to your Bluevine checking account or sub-accounts

You can earn 3.0% APY on balances up to $250K with our Plus plan and 4.0% APY on balances up to $3M with our Premier plan. With our upgraded Plus and Premier plans, APY is earned automatically with no spend or deposit requirements.

Our Business Checking customers enjoy a straightforward fee structure. We don’t charge monthly fees,BVSUP-00122 overdraft fees, incoming domestic wire or ACH fees,BVSUP-00137 or in-network ATM fees.BVSUP-00004 We also don’t have a minimum balance requirement or limits on the number of transactions you can perform.BVSUP-00043

We do charge fees for certain transactions, such as outgoing wire transfers or international payments. Learn how Bluevine’s fees compare to other business checking accounts.

Yes, Bluevine accounts are FDIC insured up to $3,000,000 per depositor through Coastal Community Bank, Member FDIC and our program banks. $3,000,000 in FDIC insurance is offered by multiplying the standard $250,000 FDIC coverage across multiple banks. Visit here for more details.

Required documentation may vary slightly depending on what type of entity your business is, but this information broadly falls into three categories:

- First, we’ll ask for some basic information to create your sign-in: your full name, email address, mobile phone number, and a secure password.

- Second, we’ll want to know about your business: trade name or DBA name, business address and phone number, EIN confirmation letter, annual revenue, entity type, and your industry.

- Third, we’ll want to learn about you and anyone who owns 25% or more of the business: home address and phone number, date of birth, SSN, and ownership percentage of the business. We may also ask for the front and back of your driver's license.

For a detailed breakdown of what you’ll need by entity type, click here.

Explore helpful guides.

Learn how to make the most of your Bluevine account with these in-depth product guides and resources.

Ready to apply for

business checking?

Submit your application in just a few minutes.BVSUP-00006