Each April, the Jump$tart Coalition organizes Financial Literacy Month with the goal of promoting financial education and literacy, especially for young people.

But accessible financial literacy resources are critical not only for consumers so they can manage their money, but for the millions of small business owners that support so much of the U.S. economy. Financial literacy statistics show the majority of small business owners report handling their own business finances, but less than half of them say they consider themselves financially literate.

Building and running a business is no small feat, and understanding business finance shouldn’t be a barrier for achieving success. Read on for a snapshot of the obstacles small business owners face when it comes to navigating their finances, as well as for some tips and resources to manage business finances like a pro:

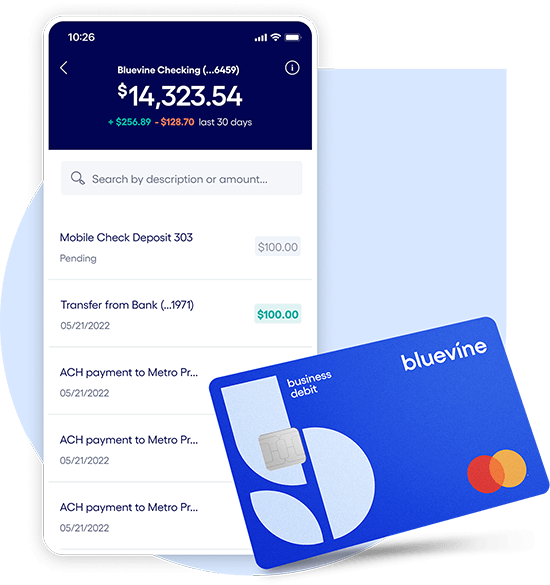

Bluevine provides banking tools to empower small businesses when it comes to their finances. For more resources to learn about financing, and managing a small business, check out Bluevine’s financial literacy glossary as well as resources available from the Small Business Association, or SCORE, which has the largest network of free volunteer small business mentors in the U.S.

Small business checking, built for your needs

Unlimited transactions, live support, high-interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more