As a business owner, you usually purchase inventory to be an asset, but it can become a liability if demand dries up. Having an effective inventory control system and demand forecasting can help you avoid that. Here’s how reducing the cost of inventory will help optimize your cash flow.

What you need to know

- Inventory management involves how you order, store, process, and sell

your company’s stock. - It’s important to use forecasting techniques like economic order quantity (EOQ) and days sales of inventory (DSI) formulas to help to optimize inventory levels.

- Different inventory management strategies have different strengths and weaknesses. Choosing the right one can significantly increase cash flow and efficiency.

What is inventory management?

Inventory management is an umbrella term referring to the way a company orders, warehouses, processes, and sells its stock. The addition of digital cataloging methods has allowed business owners to automate much of their process. There are many different styles of analysis and management that can save you money at different stages.

Effective forecasting and cost control

There are several ways to forecast demand, and every style of inventory management heavily relies on using them. Here are several specific strategies to help you estimate your sales needs.

Activity-based costing (ABC)

You can use activity-based costing (ABC) to rank your inventory items based on cost, demand, sale price, and risk. This analysis helps you understand the overall costs and tradeoffs of your inventory items, which can help you categorize and streamline your stock.

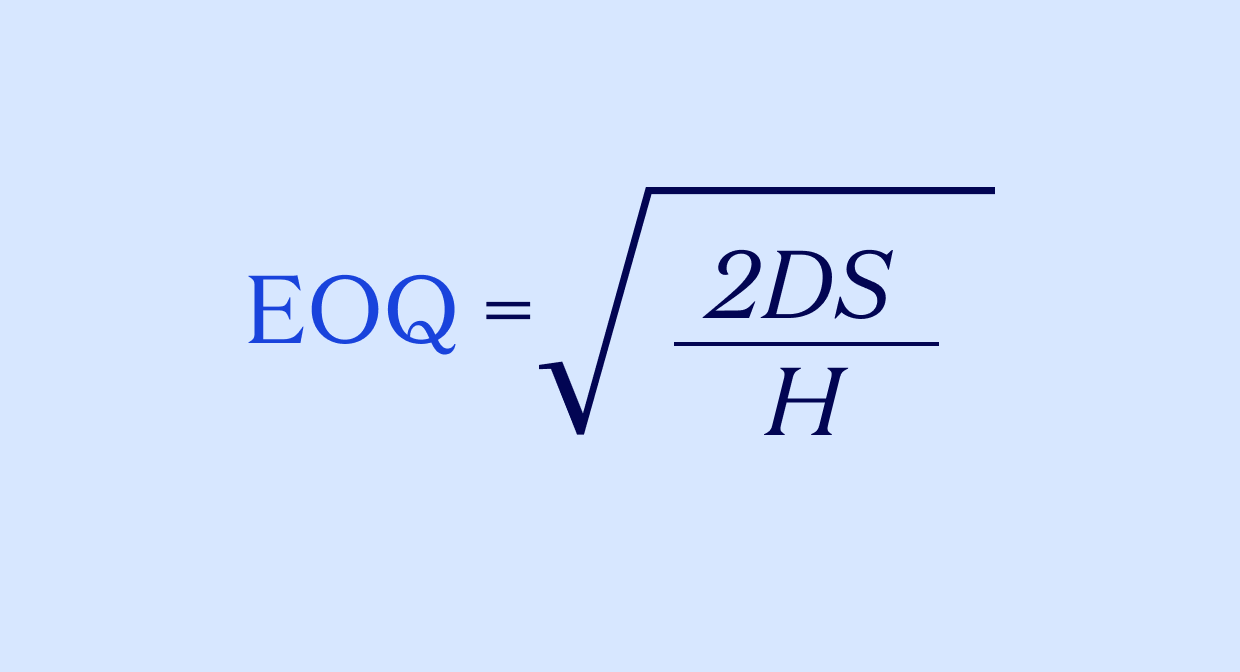

Economic order quantity (EOQ)

D = Demand, number of units you can expect to sell per year

S = Cost of the purchase order

H = Cost of holding it in inventory per year

One way to forecast inventory is with the economic order quantity (EOQ) formula. Based on customer demand, this formula tells you the optimal amount of something you should purchase if you want to minimize inventory costs.

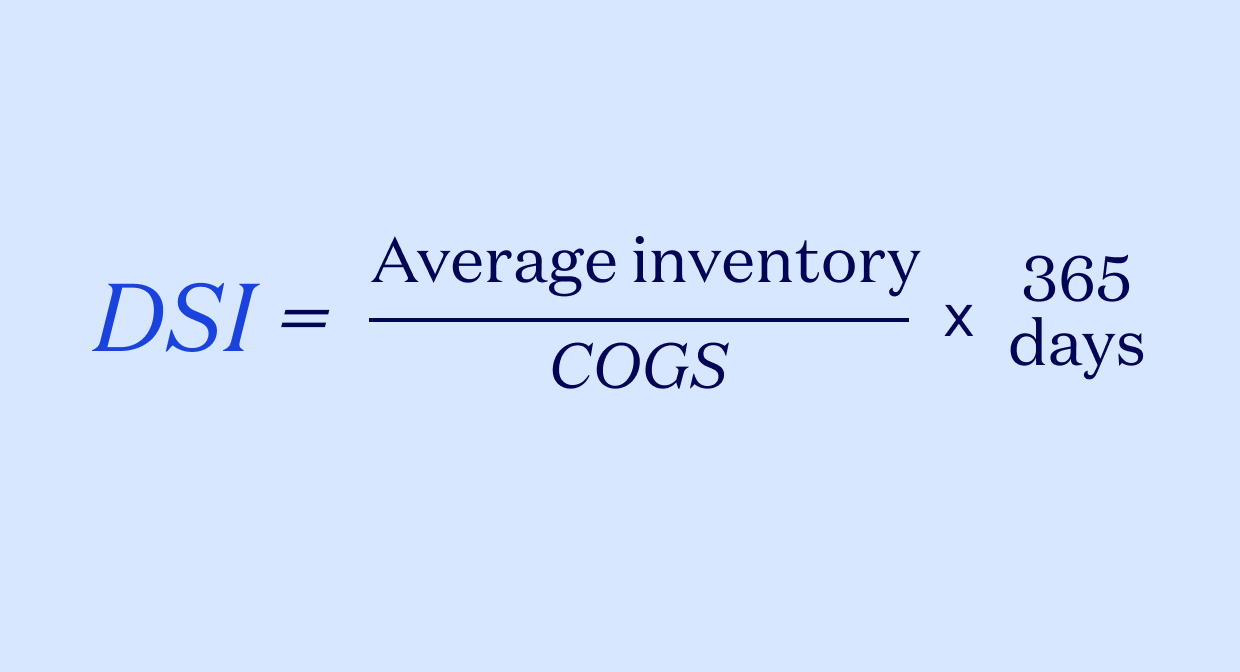

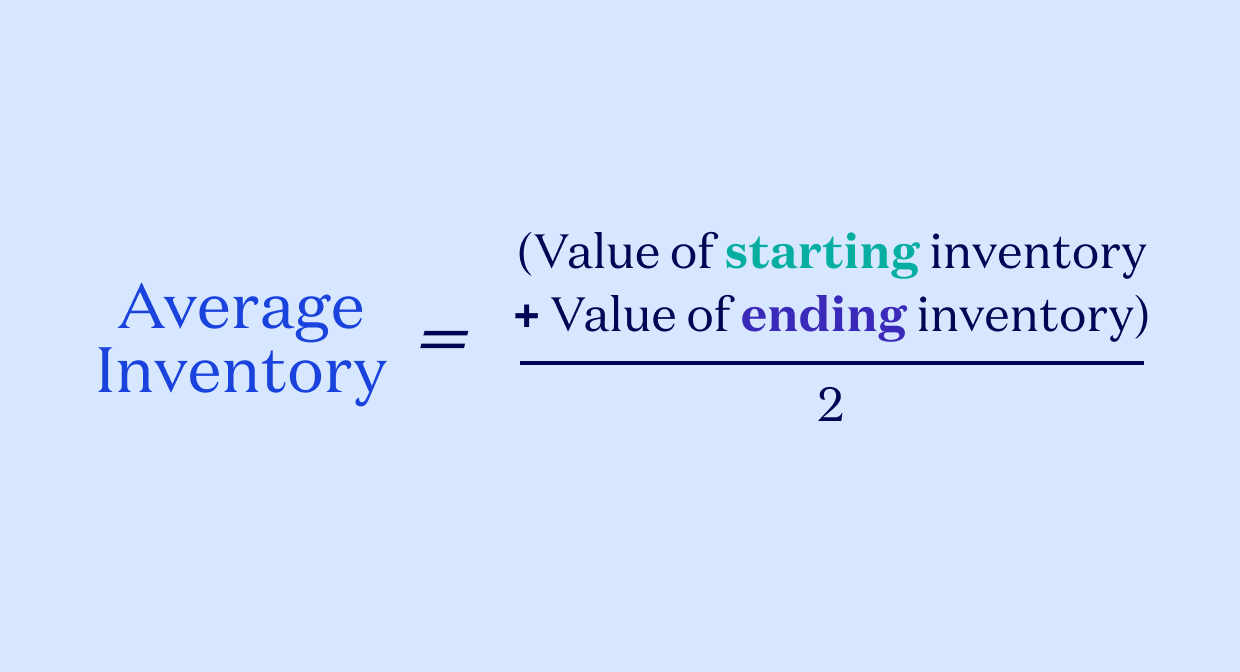

Days sales of inventory (DSI)

COGS = Cost of goods sold

To help forecast cash flow—i.e., how much of your funds are wrapped up in inventory—use the days sales of inventory (DSI) formula to find the average number of days it’s taking you to turn your inventory into sales. A low DSI indicates that you’re keeping a lean inventory by selling quickly, while a high DSI may mean that you’re spending too much on inventory or that you’ve simply stocked up extra.

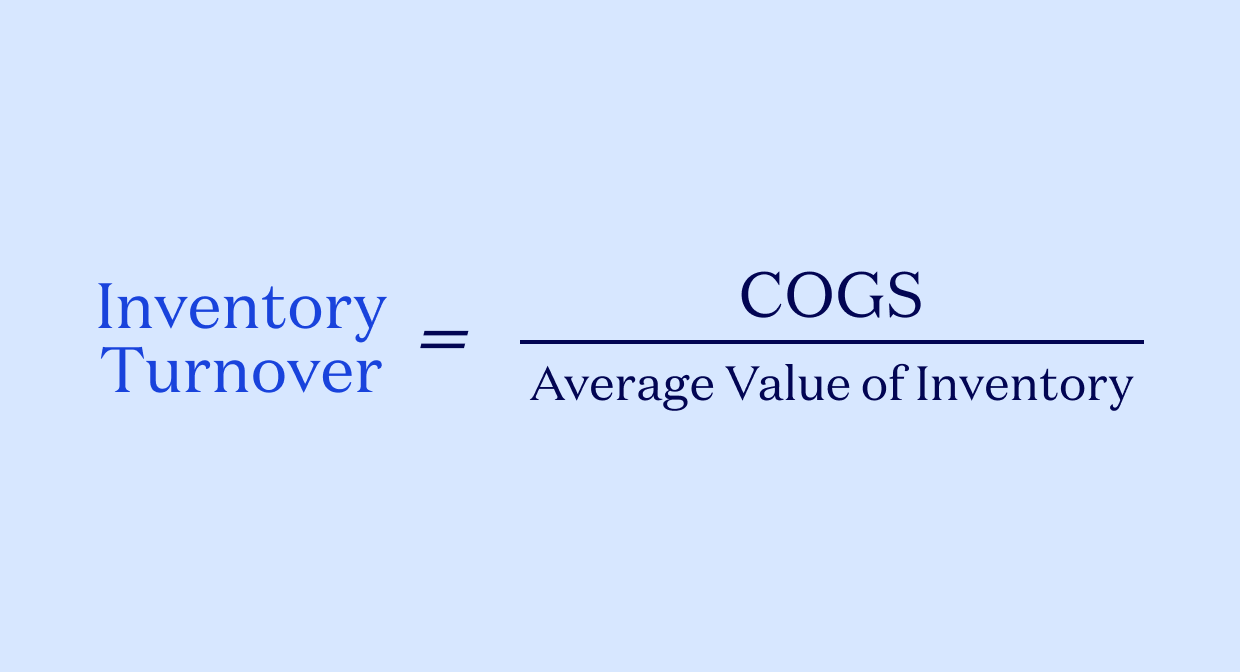

Inventory turnover ratio

COGS = Cost of goods sold

Another way to help control how much you spend on inventory is to pay attention to your inventory turnover ratio. You find this ratio by dividing the cost of goods sold (COGS) by the average value of your inventory. A high ratio indicates strong sales but could also mean you’re understocked. A low ratio means you’re overstocked. Ideally, your restock rate should match your sales cycle.

The four main types of inventory management

Every business is different, so choose an inventory management style that’s best suited to your needs.

Just-in-time (JIT) system

In a just-in-time (JIT) strategy, inventory is ordered as close to its forecasted sale as possible, to minimize storage costs. This system is ideal for optimizing cash flow because it deliberately minimizes storage costs, but keeping a super-lean inventory makes production delays much more risky.

Materials requirement planning (MRP)

When using a materials requirement planning (MRP) strategy, automated software estimates how much inventory you need to buy based on production and sales forecasts. This strategy balances supply and demand to ensure you have enough stock even in times of reduced manufacturing such as delays. However, an MRP strategy relies on accurate data to work, and can increase your storage costs as you’ll have a less lean inventory than a JIT system.

First in, first out (FIFO)

Choosing which inventory to sell first can determine your inventory management strategy. The first of these is the first in, first out (FIFO) strategy, in which you move your oldest stock first. This aligns with most natural flows of inventory, in which any products that might stagnate if left too long get sold first.

Last in, first out (LIFO)

Compared to FIFO, the last in, first out (LIFO) method moves your newest stock first. allowing you to write off the most recent inventory costs. LIFO can be useful for businesses whose products won’t stagnate looking to increase cash flow. During periods of inflation, your COGS for recent higher-priced inventory is sold before your lower-cost older inventory, and having higher COGS reduces your taxable income.

Supplier and vendor management

To be successful, small business owners need to cultivate relationships. To save money on inventory management, it’s especially important to also manage your distributors, vendors, and suppliers. Here are some strategies to reduce costs and/or delays:

- Don’t rely on a single supplier for your most important stock

- Negotiate payment terms when you can

- Monitor the quality and timeliness of deliveries to reduce delays

It often saves you money to buy in bulk, but when ordering stock you don’t need much of, note that suppliers often have a minimum order quantity (MOQ). If you can’t afford to store the minimum order quantity, try to negotiate—for example, ask if you can buy a different item in bulk and attach a small quantity of the MOQ item to the order. Or, you can see if another supplier is offering a lower MOQ for the item.

Inventory review and auditing

Regular inventory audits are necessary to ensure accuracy and responsible cash flow management. You’ll want to review the following:

- What you have in stock and how much

- The cost of your stock

- The potential sale value of your stock

- Your forecasted turnover (how much you can expect to sell and how soon)

- Sales performance of previous stock

- The physical condition of your storage facilities

Enterprise resource planning (ERP) software can help you analyze customer behavior and connect your inventory management to your overall business strategy. ERP software provides a holistic look at your business that may reveal surpluses and opportunities to improve cash flow.

Training and compliance for inventory management

Schedule regular training and compliance updates for all staff involved in inventory management. Stay informed by taking a few courses yourself, as techniques and tools for inventory management change every year, and ensure you’re compliant with government regulations and industry standards.

See how you can use sub-accounts to manage cash flow and set aside funds for inventory.