Vendors are an instrumental part of doing business. Whether it’s supplying raw materials for your construction business or providing inventory for your local coffee shop, vendors keep your business moving and your supply chain running smoothly. As such, managing your vendor payments is critical to your success as a small business owner—especially when you find a way to make your payments work even harder for you. Paying your business bills with a dedicated credit card is one way to reap additional benefits with each recurring payment to vendors.

What is bill pay and how does it work?

Online bill payments empower you to securely pay vendors without having to manually write out a check and mail it. The best bill pay platforms offer a variety of payment options, including having your payment delivered via ACH, wire transfer, or even a printed and mailed check.

Some even allow you to pay your bills with a credit card, so you can use your business credit card funds and free up cash flow. While you enjoy the benefits of bill pay by credit card, your vendors can still get paid according to their preferred method of payment; it’s a win-win. The best bill pay platforms let you use your credit card to send payments to vendors who don’t even accept cards.

Here are the four biggest benefits of paying your bills with a business credit card.

1. You can establish a financial cushion.

Perhaps one of the biggest perks of paying business bills with a credit card is that it gives you a cushion for your cash flow. For every business owner (and especially new ones), there are going to be times when you need to pay your vendors but also need cash on hand for one reason or another. Having the option to pay your vendors by credit card allows you to take advantage of additional float between when the transaction takes place and your next billing cycle. With Bluevine, that can mean up to 45 days of float, depending on your credit card issuer. That extra window of time gives you peace of mind and prevents slowdowns or unexpected changes in cash flow from throwing off your finances.

2. You can rack up rewards.

Just like you might opt to use a credit card on personal expenses in the interest of earning cashback or rewards, the same logic applies to using a credit card to pay business bills. Depending on the credit card you decide to use for business expenses, you can earn a wide range of rewards that best serve your small business needs. For example, you might choose to open a business credit card specifically for business-related expenses. In that case, the rewards you get for every transaction may be more aligned with traditional business needs (e.g., office supplies). If you’d rather earn travel rewards or cashback, you might be better off with a consumer credit card that you use solely for business purposes. Figure out what rewards and perks will be most meaningful for you and your business, and go from there.

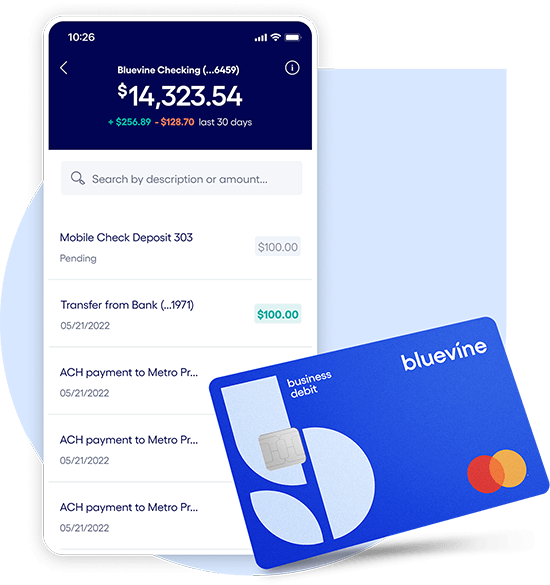

Small business checking, built for your needs.

Unlimited transactions, live support, high-interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

3. You can track expenses more easily.

Having a credit card that you use for all of your business expenses makes it easier to track all the money that you’re spending on your business. Having an itemized list of different transactions also helps you categorize all your expenses and streamline your accounting, which can be a huge help come tax season. Again, all of this is true regardless of whether you opt for a business credit card or a consumer credit card. The most important thing is that the card you decide to use to pay vendors and business bills is a card used solely for that purpose.

4. You can boost your credit score.

If you decide to open a business credit card to pay vendors and business bills, this could also spell good news for your business credit. Obtaining financing in the form of a business line of credit as a new business owner can be difficult, as you won’t have the credit history to prove you’re a qualified borrower. Luckily, business credit cards are a little easier to qualify for as a new business owner and allow you to establish a strong track record and build your business credit. Not only does that help you qualify for financing to grow your business, but it can create a ripple effect of benefits like lowering insurance premiums, reducing interest rates, and helping you secure a lease for office or retail space.

See how the Bluevine Business Cashback Mastercard® can fuel your success.