Update: Paycheck Protection Program has ended

It was our honor to have supported more than 300,000 small businesses with COVID-19 relief loans to help them cover expenses, pay employees and get back on their feet.

For the best tips on running and scaling your growing business, check out the latest on our blog:

The Paycheck Protection Program (PPP) loan forgiveness program offers applicants with a unique opportunity to have some—or all—of their loan forgiven, so long as they meet certain criteria. Knowing the PPP loan forgiveness rules and which PPP loan forgiveness application to use may maximize the amount of your loan that ends up not having to be repaid.

PPP loan forgiveness rules from the Small Business Administration (SBA) have undergone several changes, and there may be more to come. With that in mind, we’ve put together an overview of the most up-to-date PPP loan forgiveness rules, application files, and guidelines as they currently stand.

What Is PPP Forgiveness?

To avoid having to repay your PPP loan, the loan must be “forgiven” by the SBA. Your loan is not automatically forgiven. Instead, you need to apply to have your loan forgiven by the SBA.

When Business Owners Should Apply for Forgiveness

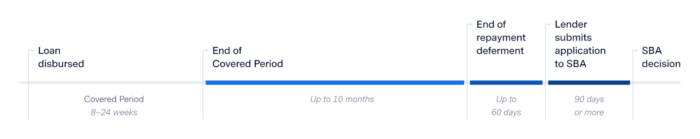

Based on the latest guidance, you’ll have up to 10 months from the end of your covered period to defer payments, and repayments, if applicable, won’t begin until Fall 2021. Bluevine will facilitate PPP loan forgiveness for the majority of the PPP loans we originated. If applicable, Bluevine will contact you once it’s time to apply for forgiveness with ample time to complete your application before your repayment date.

PPP Loan Forgiveness Program Guidelines for Businesses With Employees

One of the most appealing parts of PPP loans is the potential to have the entirety of the loan forgiven. The amount of forgiveness provided by the SBA depends largely on employee-related matters during the term of the PPP loan, as well as how the PPP loan proceeds were spent.

The program offers full forgiveness for businesses with employees so long as they maintained staff levels, didn’t reduce salaries by more than 25% for employees making less than a $100,000 annualized salary, and used at least 60% of the total funds towards paying employees and staff.BVSUP-00014

If you used less than 60% for paying employees and staff, you are still eligible for forgiveness, but your forgiven amount may be reduced.

There are also other conditions within PPP loan forgiveness requirements that deal with how funds can go towards other purposes. So long as you used no more than 40% of your loan to pay for mortgage interest, rent payments, utilities, or other eligible expenses, you are likely to have the total amount of these expenses forgiven as well.

With a completed PPP loan forgiveness application form filled out, you’ll submit this and other documents (as necessary) to your lender in order to begin the process. If you received your loan from Celtic Bank through Bluevine, this process is digitized, and we’ll reach out when it’s the right time to apply.BVSUP-00022 The SBA is accepting forgiveness applications, but applicants have up to 10 months from the end of your covered period to apply for loan forgiveness. Repayment, if applicable, won’t begin for most applicants that got their PPP loan from the first round until Fall 2021.

PPP Loan Forgiveness Program Guidelines for Self-Employed Borrowers without Employees

PPP loan forgiveness for self-employed applicants without employees—including sole proprietors, independent contractors, and partnerships—works slightly differently than it does for businesses with employees.

Most of the major conditions remain the same:

- Self-employed applicants still need to use at least 60% of their loan to cover payroll (or profit, in this case).

- Any non-payroll expenses must be PPP-eligible expenses (e.g., mortgage interest, rent, utilities).

The major difference comes down to calculating wages and payroll: self-employed PPP recipients do not have employees other than themselves or their business partner(s), depending on their business entity. Therefore, there is no employee payroll information or calculations required.

The deadlines and processes around submitting forgiveness applications are the same for self-employed individuals as for businesses with employees. If you received your loan from Bluevine, this process will be digitized, and we’ll reach out when it’s the right time to apply. Applicants have up to 10 months from the end of your covered period to apply for loan forgiveness, and repayments, if applicable, won’t begin for most applicants that got their PPP loan in the first round until Fall 2021.

What You Need Before Applying for PPP Loan Forgiveness

Whether you’re filling out form 3508S, 3508EZ (EZ, for short), or the regular 3508 (long form, for short), there are several steps you’ll want to take before you begin.

All PPP loan forgiveness applicants—excluding applicants using the 3508S form—will need to provide proof of how they spent their funds. This includes documentation of PPP-eligible payroll and non-payroll expenses.

Applicants that have employees will want to pay special attention to documents pertaining to staffing. If a business had to reduce staffing or wages during its covered period, that may affect forgiveness. Several exceptions exist, so read our guide on staffing and wage reductions for more information. Businesses should keep detailed records of any staffing reductions or reduction and any efforts to restore them.

Which PPP Loan Forgiveness Application to Use

Once you’ve collected bills, payroll details, and any other necessary documentation from your covered period, you’re on your way toward filling out the application. Next, you’ll need to determine which forgiveness application you should use: form 3508S, form 3508EZ, or form 3508.

Who Can Use the 3508S Form

Businesses that received PPP loans of $150,000 or less use the short 3508S form. This is a simple one-page attestation, but you still need to do calculations. You don’t need to submit any additional documents besides the 3508S form.

Who Can Use the EZ Form

To be eligible for the 3508EZ form, businesses generally need to meet a few criteria:

- They must not have reduced employee pay by more than 25% during their covered period.

- They either (A) must not have reduced staffing levels or (B) must have been unable to fully operate during their covered period due to COVID orders from the Secretary of Health and Human Services, CDC, or OSHA.

We recommend reviewing the EZ instructions for complete eligibility requirements.

Who Can Use the 3508 Long Form

Businesses that received PPP loans greater than $150,000 and do not qualify for the EZ form may use the 3508 long form. The long form generally requires the same calculations required in the EZ form, but with some additional pieces. The long-form version also contains several worksheets to help determine how much of your loan is forgivable, as well as additional information about your staffing before and after your loan period.

How to Fill Out the PPP Loan Forgiveness Applications

PPP loan forgiveness applications generally ask for information like the following:

- SBA PPP loan number

- Lender PPP loan number

- PPP loan amount

- PPP loan disbursement date

- Employees at time of loan application

- Employees at time of forgiveness application

What is the Covered Period?

The forgiveness application will ask you about the “covered period.” This is the period beginning on the day of your first loan disbursement and ending 8 to 24 weeks later.

Read our guide on considerations when choosing your covered period.

Forgiveness Amount Calculations

This is where the numbers come into play, and the total forgivable amount of your loan gets calculated. Make sure you have all of your information about payroll and other qualifying expenses at the ready before you begin.

Payroll and Non-payroll Costs

For the 3508S form, you aren’t required to list how much of your PPP loan went to various expenses; however, you should be prepared to provide this information in case the SBA requests it later.

For the 3508EZ form, you will need to calculate how you used loan proceeds to pay for approved uses. You’ll have to list out how much money from your loan went to:

- Payroll costs

- Business mortgage interest payments

- Business rent or lease payments

- Business utility payments

- Covered operations expenditures

- Covered property damage costs

- Covered supplier costs

- Covered worker protection expenditures

Payroll costs can include:

- Healthcare plan payments—for businesses with employees

- Salary, wages, commissions, and tips—up to $100,000 for each employee on an annualized basis

- Employee benefits—which includes paid leave not otherwise covered by the Families First Coronavirus Response Act, severance pay, insurance premiums, and retirement benefits

- State and local taxes—which are assessed on employee pay

- Payments for vacation, parental, family, medical, or sick leave; an allowance for separation or dismissal

- Employer-provided group insurance benefits; including, life, disability, vision, and dental insurance, including insurance premiums, and retirement

- For a sole proprietor or independent contractor: wages, commissions, income, or earnings from self-employment

You can only include payroll costs that are:

- Incurred and paid during the covered period,

- Incurred before but paid during the covered period, or

- Incurred during but paid on the next regular payroll date after the covered period.

The amount of payroll you can include for each employee is capped at an annualized rate of $100,000:

- For an 8-week covered period, this would be $15,385

- For a 24-week covered period, this would be $46,154

- If you have a covered period between 8 and 24 weeks, your per-employee payroll cap should be prorated based on an annual $100,000 limit

Additionally, you can only include payroll costs for employees that primarily reside in the US.

Owner-employees—employees that also own the business—have special limits on forgivable payroll:

- Generally, you can only include owner-employee compensation up to the lesser of

- The prorated portion of 2019 or 2020 profit, as applicable, for a covered period up to 2.5 months, or

- 2.5 months’ worth of 2019 or 2020 profit for a covered period longer than 2.5 months

Remember that, for self-employed applicants, payroll costs can be considered any payments made directly to yourself from your loan—including disbursing the full amount to yourself. The SBA has indicated that self-employed persons healthcare benefit costs should be already included in net income reporting on Schedule C. So self-employed persons are not permitted to separately list these costs as a payroll expense for forgiveness purposes.

This section will also ask you for the total amount of money you used from your loan to pay for business mortgage interest payments, business rent or lease payments, business utility payments, covered operations expenditures, covered property damage costs, covered supplier costs, and covered worker protection expenditures. If you used PPP funds for any of these additional purposes, include the total amount for each based on the corresponding category.

Ultimately, you are responsible for ensuring your calculations adhere to SBA guidelines. For more information on the forgivable costs, please refer to the SBA’s PPP forgiveness page

Adjustments for Full-Time Equivalency and Salary/Hourly Wage Reductions

Form 3508S and the long form required you to crunch some numbers about the number of staff you employed during your covered period, their cash compensation, non-cash compensation (e.g., health insurance or retirement plan contributions), hours on the job, and compensation paid to business owners. This is not required for the EZ form. All of the information required in this section is explained in the PPP Schedule A worksheets, and discussed below in its own section.

Potential Forgiveness Amounts for EZ Form

This section is only relevant for the EZ form and serves as a preamble to the actual amount of forgiveness you’ll be applying for. It adds together several of the preceding lines to reflect how your PPP loan funds were spent, and if they were apportioned to the right expenses. What you enter on these lines will directly impact your actual forgiveness total, so be sure that your information is accurate so far.

Line 9, which calculates the sum of the values you’ve entered in lines 1 through 8 on the EZ form. Line 1 through 8 calculates all of the money spent from your loan total to cover payroll, mortgage interest, rent,utilities, covered operations expenditures, covered property damage costs, covered supplier costs, and covered worker protection expenditures.

For line 10, you’ll provide the total amount of the PPP loan you received. For line 10, take your line 1 total and divide it by .60. This number should reflect the percentage of your overall payroll costs and will help determine if you’ve allocated the right percentage of your loan toward payroll concerns.

Forgiveness Amount for EZ Form

This section is only relevant for the EZ form and is your total forgivable loan amount, tabulated based on the information you provided on each of the other lines in the Forgiveness Amount Calculation section of the EZ form. You’ll whichever total is the smallest from lines 9, 10, or 11. This is the amount of money you are seeking to have forgiven on the application, so be sure you’ve arrived at the right calculations throughout the entire section.

Depending on how you used your funds, you may see either a portion of your total loan on line 11 or even the entirety of it. Applicants who strictly followed the SBA guidelines should not be surprised if their forgiveness amount equals the total of their PPP loan. If, on the other hand, your entry for line 11 doesn’t reflect your loan total and you’ve made sure that you qualify for full forgiveness, reach out to your accountant for more guidance.

Understanding and Filling Out Schedule A for PPP Loan Forgiveness Long Form

The long form application includes an additional page, called Schedule A, which includes several entry fields to help you determine total payroll costs and how they factor into the details you’ll provide in the “Adjustments for Full-Time Equivalency and Salary/Hourly Wage Reductions” section of the forgiveness form.

Here’s a walk-through of the different sections on Schedule A.

PPP Schedule A Worksheet, Table 1 Totals

The first section of Schedule A, titled “PPP Schedule A Worksheet, Table 1 Totals,” outlines certain employee information from Table 1 of the PPP Schedule A Worksheet (described below). Your completed data from Table 1 then goes into this section on lines one through three of Schedule A.

Table 1 can be found on the PPP Schedule A Worksheet (page four of the application). This table asks you to list out your employees’ names, an identifying number for the employee, their cash compensation—including salary/wages, commissions or tips received, paid leave, and severance pay—how many hours they work—even if full-time—and any reduction in their hourly wages or salaries.

For Table 1, you only need to include employees who are U.S. residents and employees that either made less than $100,000 in 2019 or are on track to make less than $100,000 for 2020.

You can also include employees who rejected offers to return to their job, were fired for cause, resigned, or requested a reduction in hours during the covered period of your loan. Review our guide for more information on these exemptions.

PPP Schedule A Worksheet, Table 2 Totals

The next section of Schedule A, titled “PPP Schedule A Worksheet, Table 2 Totals,” addresses employees that received compensation at an annualized rate of more than $100,000 in 2019 and were employees during the covered period of the loan (or the alternative payroll covered period, if applicable). Table 2 can be found on PPP Schedule A Worksheet (page four of the application).

The PPP was designed to cap employee payments at an annualized rate of $100,000, so the SBA wants to know how many employees might fall into this category for your business. You’ll also have to fill out their average FTE (more on that below).

Non-Cash Compensation Payroll Costs During the Covered Period

The “Non-Cash Compensation Payroll Costs During the Covered Period” section of Schedule A deals with expenses that you used your PPP loan to pay employee-benefits like health insurance and retirement plan contributions. You can also list out any payment of state and local taxes as based on employee compensation here as well. You’ll want to make sure you’re thorough here, as all of these expenses can be forgiven if accounted for properly.

Compensation to Owners

For line nine of Schedule A, you will need to include any compensation paid owner-employees, self-employed individuals, or general partners. In other words, any money paid out to business owners during the covered period needs to be reflected here. If more than one owner received compensation, you’d need to add a table that provides the names of each owner paid out, as well as the payments each of them received. As described above, there are limits on how much owner-employee compensation you can include in your forgiveness application.

Total Payroll Costs

For this section, add lines 1, 4, 6, 7, 8, and 9 together to arrive at the total amount you’ve spent toward qualifying payroll costs during the duration of your loan.

How to Calculate Your FTE

The, Full-Time Equivalency (FTE) Reduction Calculation, section addresses any reductions in staff or working hours that may have arisen during the covered period of your PPP loan. You can skip lines 11–13 if you satisfy these three conditions:

- You kept your staffing/FTE the same during the term of your loan as it was earlier in 2020

- You couldn’t operate normally due to health regulations (i.e., FTE Safe Harbor 1)

- You ended up with a higher FTE at the end of your loan (or at the end of 2020) than you did when you got your loan, and your FTE as of February 15, 2020, was greater than your FTE average between February 15–April 26 (i.e., FTE Safe Harbor 2)

FTE is a way of reflecting how much staff you hired both before and during the duration of your covered period, reflected as a number. You’ll want to make sure your FTE figure is as high as possible so that you can meet or exceed the PPP loan requirements for forgiveness.

There are several FTE figures you’ll need to calculate as part of your forgiveness application. The first is your average FTE during a chosen reference period, which serves as your pre-loan benchmark for full-time equivalent figures. You can determine your average FTE from one of two reference periods: February 15, 2019–June 30, 2019, or January 1, 2020–February 29, 2020. If you’re a seasonal employer, choose one of the options above or a consecutive 12-week period between February 15, 2019, and February 15, 2020. Some in the accounting industry suggest that whichever period yields a lower FTE number may be the better option, as you will want this number to be as close to the FTE during your covered period as possible. This figure goes on Line 11.

The total average FTE during the covered loan period can be calculated in one of two ways. The simple way is to count full-time employees at working 40 hours per week each, and part-time employees at 20 hours a week each. You also have the ability to add up all employee weekly hours individually, of course. This may be helpful if you are unsure that you’ll be able to meet or exceed the FTE you calculated for your chosen reference period, as this will determine how much of your loan can be forgiven.

Keep in mind that employees who were offered their jobs back, and rejected the offer, do not get counted against your FTE calculations. As long as you can document the offer and rejection, you will not be on the hook for these employees from an FTE perspective.

PPP Borrower Demographic Information Form

The SBA included this voluntary section in all forgiveness forms to get a sense of how certain demographics factored into the overall program.

Bluevine is required by the SBA to ask this information. You’re not obligated to provide this information; however, if you choose to do so, it’s as simple as listing your veteran status, gender, race (or ethnicity). This information will have no impact on your forgiveness decision.

How to File for PPP Loan Forgiveness

Applicants will file for forgiveness through their lender—be it through a paper version of the application form or electronically.

Bluevine is working on digitized versions of these forms within the platform. If your PPP loan originated with us, expect further communication in the days and weeks to come.

What to Expect After Filing for PPP Loan Forgiveness

Your lender has 60 days to review your forgiveness application, and the SBA may take 90 days or more to review once your lender submits your application. As of now, we can anticipate about a 90 day processing period once your forgiveness application has been submitted to the SBA.

Ultimately, you are responsible for ensuring your application is accurate and correct, and the SBA is responsible for determining how much forgiveness your loan is eligible for. If your lender fully denies your loan forgiveness, you may appeal to the SBA. Otherwise, you can only appeal a partial forgiveness decision after your lender has submitted it to the SBA, and the SBA has issued its decision. Partial forgiveness decision appeals must be done through the Office of Hearings and Appeals. .

The terms of the loan are two or five years, and the interest rate is 1%. Even in the worst-case scenario, a PPP loan is still much less expensive than a typical loan, which is good news for applicants.

Summary

The PPP Loan Forgiveness program is complicated, but the opportunity to have a fully forgiven loan is extremely advantageous for small business owners. The program has been a lifeline for many small businesses across the country. Applying for forgiveness is one of many smart business decisions to make as we ride out a turbulent economic period for entrepreneurs and business owners across the country. For further information regarding the forgiveness process, please consult the PPP Forgiveness Rules published by the Small Business Administration (SBA), in consultation with the Department of the Treasury.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more